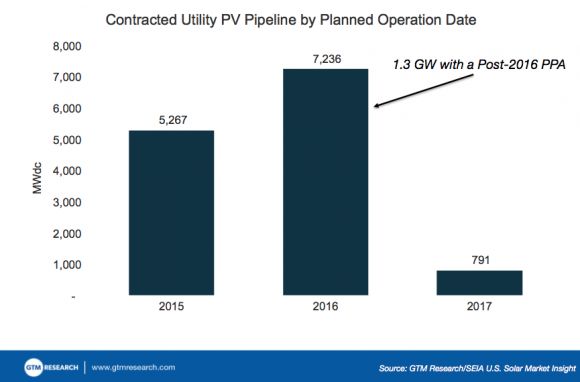

Over the next two years, America will build roughly 13 gigawatts of utility-scale solar PV plants. When up and running, those projects will surpass the country's cumulative solar capacity across all sectors reached at the end of 2013.

Why such a big surge in utility-scale solar after a brief slowdown in the project pipeline?

The answer is price.

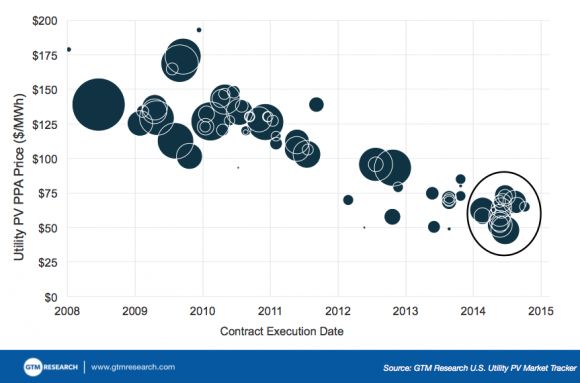

Utilities are now able to consistently buy solar electricity from large plants for between 4.5 cents and 7.5 cents per kilowatt-hour, as shown by GTM Research data below.

Between 2008 and 2010, when America saw its first surge of utility-scale PV construction, power-purchase agreements were consistently priced at double or triple those prices (or even more).

A very important trend unfolded at the end of 2013 and into 2014: Utilities started buying more solar electricity outside of state mandates as prices for long-term solar contracts fell dramatically.

Because solar PV now beats natural gas on a levelized-cost-of-energy basis in numerous markets, it has become more prominent in competitive utility solicitations. That has opened up a half-dozen new markets around the country that had virtually no utility-scale projects before 2013.

Last September, as solar started to outbid gas, an executive at Xcel Energy explained the crossover: “This is the first time that we’ve seen, purely on a price basis, that the solar projects made the cut -- without considering carbon costs or the need to comply with a renewable energy standard -- strictly on an economic basis."

In fact, power-purchase agreement prices in the sector have fallen faster than average system prices on a percentage basis, according to GTM Research analysis.

The pressure on developers to drop costs is getting more intense. Solar companies building large projects for utilities are "operating on the need to be really, really cheap right now," said Shayle Kann, VP of GTM Research, in a presentation this week.

That raises another factor contributing to the price drop: the federal Investment Tax Credit (ITC).

Equipment and installation costs have consistently moved downward. But "you can only get those kind of numbers with the ITC in place," said Kann.

In anticipation of a phase-down of the ITC in 2017, developers are pushing all their projects into 2015 and 2016. Assuming Congress does not extend the ITC, installations will likely fall from 7.2 gigawatts to less than 1 gigawatt in 2017.

A lot could happen in the solar industry over the next two years. Since 2010, the average weighted price of installed solar PV across all sectors has dropped more than 61 percent. But solar companies are not taking any chances.

There are 2 gigawatts of utility-scale plants in the pipeline for 2017. Developers plan to bring nearly two-thirds of those projects on-line in 2016 without a contract in order to secure the ITC -- opting to bridge the gap themselves for a year.