Yes, Smokers Can Obtain Cheap Life Insurance Rates. Sometimes Even At Non-Smoking Rates. Here Is How.

Updated: April 12, 2024 at 9:38 am

I think you’ll agree that smokers have a hard time finding affordable and cheap life insurance.

I think you’ll agree that smokers have a hard time finding affordable and cheap life insurance.

Premiums are nearly double or triple – or much more – compared to that of non-smokers.

However, it is possible for smokers to obtain cheap life insurance, sometimes even at non-smoking rates.

For example, one carrier we work with provides non-smoker life insurance rates for smokers. (In other words, they will apply non-tobacco life insurance rates for tobacco users.) There are specific provisions you need to meet, and we discuss this further in the article.

Nevertheless, we have helped many smokers save money on life insurance.

Here’s what we will talk about in this article. This is a rather long article because of the topic. So, feel free to click around to your needs.

- #1 Goal For Smokers Seeking Life Insurance

- Your Smoking Situation Matters In Finding Life Insurance

- How Life Insurance Carriers Underwrite Smokers (And Tobacco Users)

- Cheap Life Insurance For Smokers And Tobacco Users

- 10 Non-Smoking Life Insurance Options For Smokers

- Strategy For Smokers Wanting Affordable Life Insurance

- FAQs About Cheap Life Insurance For Smokers

- Burial Insurance For Smokers

- Now You Know Smokers Can Obtain Cheap Life Insurance!

Let’s start off by discussing how your situation fits into all of this.

The #1 Goal For Smokers Seeking Life Insurance

Only one goal exists for smokers and tobacco users when seeking life insurance.

That goal is: to find the best and lowest premium life insurance, preferably at non-tobacco rates.

So, for smokers, your #1 goal is to find life insurance at (preferably) non-tobacco rates.

We at My Family Life Insurance have been successful in finding smokers, and all sorts of tobacco users, life insurance at non-tobacco rates.

In this guide, we will show you how you can do this, by first discussing how your tobacco situation affects your life insurance options.

How Your Smoking / Tobacco Use Situation Matters With Life Insurance

Recently, I received a phone call. “John,” the person said. “I smoke cigarettes. How do I get life insurance to protect my family, and not pay a lot?”

The answer to most questions about life insurance is, “it depends”. The same is true about how much a smoker will pay for life insurance.

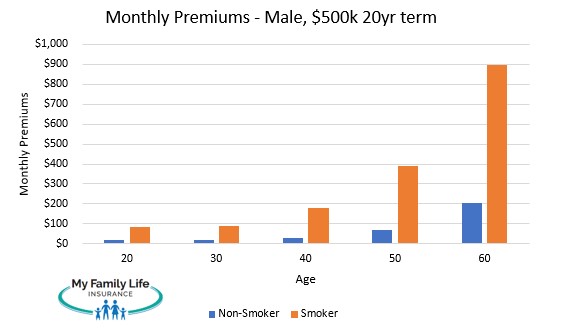

It’s true; a smoker generally pays much more in life insurance premiums than a non-smoker. Just look at the graph below. It is for a male who is very healthy every which way. He does not take any medication and is in great health. The one exception is he smokes 1 pack a day.

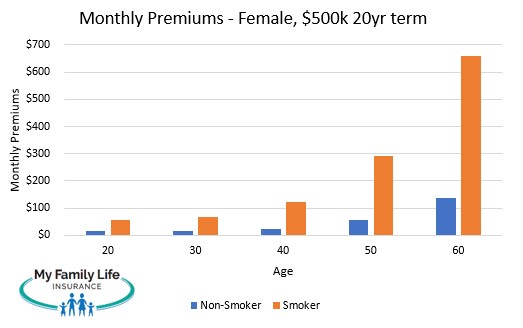

You can see how the premiums increase drastically as the application age increases. If you are age 50 and need $500,000 in life insurance, you can see that you’ll pay $400 per month whereas a non-smoker will pay less than $100.

The same for women as well. Women who smoke or use tobacco will pay higher rates compared to those who don’t.

The reason for the higher life insurance rates? It is rather obvious. Smoking and tobacco usage are directly proportional to your life expectancy. Tobacco use potentially leads to:

- cancer – lung cancer, especially

- heart disease

- COPD

- lung issues

- stroke

If you are a regular tobacco user, you’ll pay higher premiums. It is a simple fact, for the reasons we describe above. The health risks associated with tobacco use are well documented as well as the shortened life expectancy. Even the best life insurance companies for tobacco users want to be compensated for that higher risk – the risk of dying too soon.

However, these examples above assume you smoke 1 pack per day cigarettes. Having said that, what you smoke or your tobacco use among other things matters. Smokers looking for cheap life insurance need to know that:

- The carrier,

- Their definition of smoking,

- How much you smoke or use, and

- The type of tobacco products you use

…all matter when it comes to looking for best life insurance rates for your situation.

We discuss this all next.

The Life Insurance Company Matters

Every life insurance carrier defines smokers and tobacco use (more on that in a minute) differently. Some life insurance carriers will include all tobacco users (i.e. smokeless tobacco and cigar) as smokers. Other carriers might classify a cigar, chew tobacco, and/or an electronic cigarette / vape as a non-smoker.

Moreover, some life insurance carriers might define smokers as someone who smoked or used tobacco in the past 12 months. Others might define someone in the last 24 months. So, if you quit in month 15, then you would want to look into the first carrier with the 12-month period and not the second.

Why are we saying this? Because your smoking/tobacco habits, and what you smoke (including marijuana), will determine which carrier is best for you. All the carriers rate you differently depending on your situation.

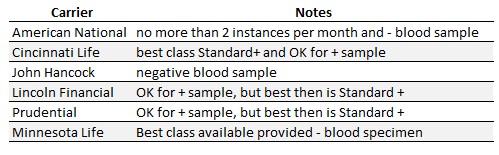

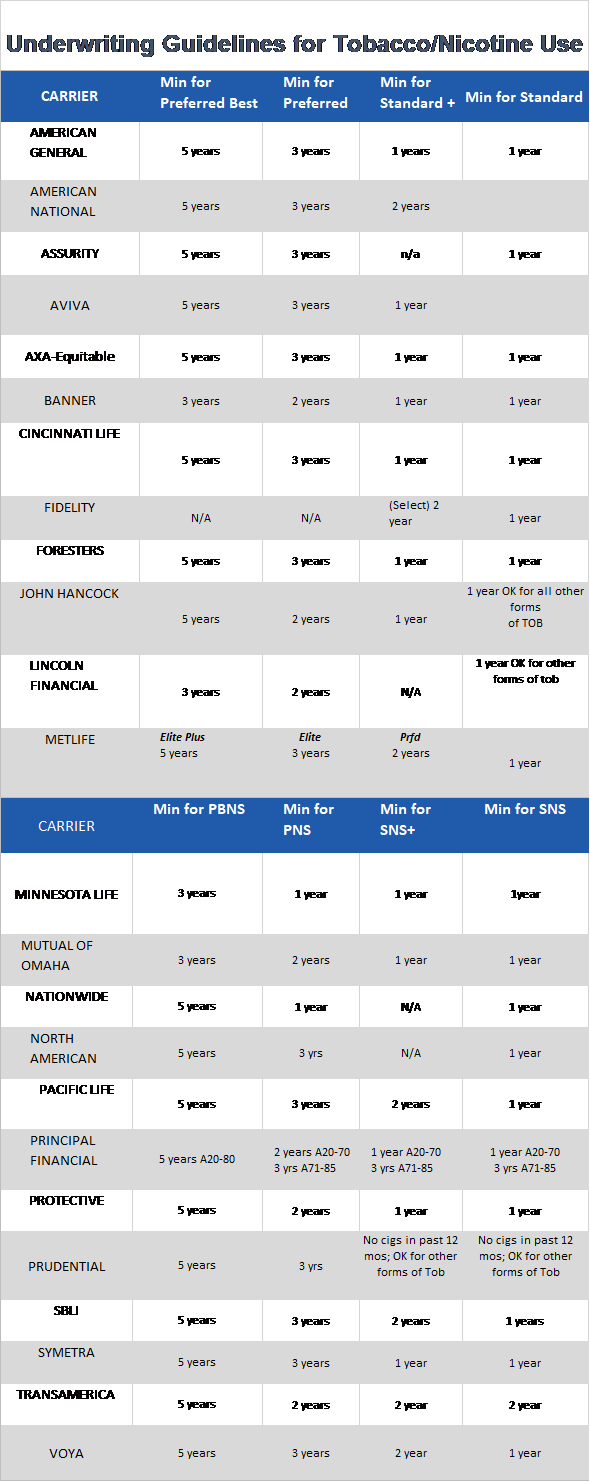

Just look at the table below. You will see differences among the carriers as it relates to former cigarette smoking use:

As you can see, you can’t just blindly pick a carrier and apply. You could end up spending thousands of your hard-earned money for no reason! (We at My Family Life Insurance won’t allow you to do that!)

The Smoking Definition Matters

The carrier matters because of its definition of tobacco use / smoking matters. For the most part, all carriers define smoking as tobacco use from a nicotine delivery system. (Yes, most carriers consider e-cigarettes as smoking, but a few don’t). Moreover, that means nicotine patches are considered tobacco use.

As indicated in the chart above, you must be nicotine-free from nicotine products for at least a year before you can qualify for non-smoker rates, There are some carriers which will regard the occasional use of cigarettes as non-smoking. We will get to that in a minute.

for at least a year before you can qualify for non-smoker rates, There are some carriers which will regard the occasional use of cigarettes as non-smoking. We will get to that in a minute.

Where carriers start to divide is their definition of a non-smoker (non-tobacco user).

Nearly all life insurance carriers define non-smokers as someone who does not use tobacco or smoke for a year (12 months). At that point, you are eligible for standard rating and nothing better. (Some carriers offer a standard “plus” rating if your health meets certain positive criteria, but you will never go beyond standard).

Once you are three years removed from smoking, you will start to feel the financial benefits. Not only will you have saved quite a bit of money (the average smoker spends over $2,000 per year for a 1 pack-a-day habit), you will also qualify for some of the better, lower rates. (Provided you are in good health).

At three years, you would qualify for preferred rates. Then, at 5 years removed from smoking or tobacco use, you would qualify for super preferred, premier, or preferred plus. (They mean all the same – the best rates!)

Your Frequency Of Nicotine Use Matters

If you smoke a pack a day, carriers will classify you as a tobacco user. There’s no way around it. You’ll have to pay those high premiums illustrated in our graph above.

Same with chew, vaping, nicotine gum, and nicotine patches. If you use these frequently, then you are a tobacco user.

However, an occasional cigarette or cigar may not matter to life insurance carriers. We address this next.

Type Of Tobacco Use, And How Often You Smoke Matters

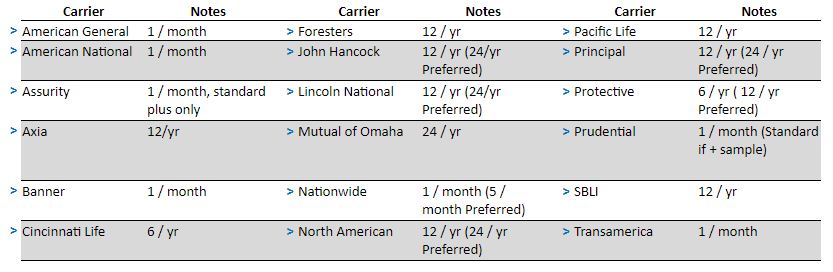

For the most part, if you smoke cigarettes or use tobacco frequently, you will be classified as a tobacco user. There are a few carriers that will allow a standard non-smoker rating if you only smoke a few cigarettes over the year. You would have to admit this on the application and meet other qualifications.

For the most part, if you smoke cigarettes or use tobacco frequently, you will be classified as a tobacco user. There are a few carriers that will allow a standard non-smoker rating if you only smoke a few cigarettes over the year. You would have to admit this on the application and meet other qualifications.

For the most part, however, if you smoke regularly, you are classified as a tobacco user / smoker.

However, some carriers have exceptions as noted below:

- The use of electronic cigarettes / vape will also classify you as a tobacco user if the electronic cigarette contains nicotine. At this time, there are only a few carriers that classify you as a non-smoker / non-tobacco user. Note: If you smoke electronic cigarettes that do not contain nicotine, then you will be classified as a non-smoker.

- If you dip or chew (smokeless tobacco), your smoker classification depends on the carrier. Some carriers classify chewing tobacco or dip at non-smoker life insurance rates. Others state it is a tobacco rating.

- The same is true for nicotine gum and patches: some carriers classify the gum and patch as non-smokers while others are classified as a smoker.

Finally, generally speaking, most carriers classify the occasional celebratory cigar or pipe as a non-smoker. Many carriers allow a preferred or preferred best rating as well. You would generally need to have your urine sample test negative for nicotine.

Does Marijuana Use Matter?

Marijuana users can be classified as a non-smoker, and there is even one carrier that will insure recreational marijuana users at preferred best provided the applicant meets the additional requirements. We wrote about life insurance for marijuana users in more detail in a separate article.

We go into more detail about the 10 cheapest, lowest life insurance options for smokers and tobacco users below. Next, though, we give an overview of the underwriting process for smokers and tobacco users.

How Life Insurance Carriers Underwrite Smokers (And Tobacco Users)

The life insurance underwriting process has come a very long way. Long ago (like 2010 🙂 ), carriers usually required a paramedical exam. This is simply a “mini” physical exam where a certified examiner comes to your home or office. The examiner takes or measures your:

- blood pressure

- urine sample

- height and weight

- medical history – through the MIB and ordering medical records if you have moderate to severe medical conditions

- a blood test / specimen – good way to see if nicotine in blood

- and anything else required

Sometimes, they will ask you the health questions again.

Nowadays, though, with artificial intelligence such as Lexis Nexus and the availability of public records, carriers are moving away from paramedical exams.

But, for smokers and tobacco users, carriers do want to make sure your blood sample does or does not contain cotinine or nicotine. Smokers and tobacco users usually need to go through a paramedical exam.

Table Ratings For Smokers And Tobacco Users

Carriers underwrite to determine your health class and premium. Every carrier has insurance tables. These are:

- Preferred Best

- Preferred

- Standard +

- Standard

These above are really reserved for non-smokers. If you smoke, you’ll be classified into these tables:

- Preferred Tobacco – you are healthy every other way but use tobacco. In other words, if you were a non-tobacco user and qualify for preferred best, you’d qualify for preferred tobacco.

- Standard Tobacco – where a majority of smokers are classed

Carriers do, in some cases, request your doctor records. They do this to confirm your health history and analyze information. It helps them make an honest life insurance offer.

Additionally, carriers still use the MIB and lookup your prescription drug history. That all indicates any potential current or previous health conditions. For example, if a carrier sees a prescription of Chantix, it knows you have had some tobacco issues.

Which brings us to a final point. Don’t lie on your life insurance application. You won’t fool the carrier, and even if you do, you’ll ultimately get caught. Moreover, getting caught may mean the carrier rescinds the policy. That means your beneficiaries DON’T receive the death benefit money. Do you want that to happen?

Regardless of your situation, we can find you the right life insurance for your situation.

This will be a good time to discuss how the carriers specifically classify tobacco / smoking use.

Cheap Life Insurance For Smokers And Tobacco Users

We are going to list the carriers, as of this writing, that will offer cheap life insurance for smokers.

What do I mean by this?

Well, the cheapest and best will be based on your situation. This is a common theme in this article.

Additionally, carriers look at your overall situation and health. This means that if you have other health conditions including smoking, then carriers base your premiums on those conditions and your overall health.

Let’s start with cheap life insurance for cigarette smokers.

Cheap Term Life Insurance For Cigarette Smokers

If you smoke a pack of cigarettes per day (or more), you are a tobacco user. There’s no getting around it for cigarettes. The best thing to do is go for the lowest-premium life insurance you can get your hands on.

Do you want to see what the premiums could be? You can do this in our quoter below. Just enter your information. Select “tobacco” for smoking status and then you’ll see the carriers with corresponding premiums. (Note: we will give you a call or send you an email to say thanks, but we don’t sell your information or call you 1,000 times per day. We are here to help, really. Not to be a bother.)

Having said this, there are a couple of carriers that will insure the occasional cigarette user (subject to change anytime).

- Minnesota Life / Securian – 1 cigarette per month at best class; 2 per month Preferred rating. You must admit on application and test negative for cotinine / nicotine in the blood sample

- Assurity – if you smoke less than a pack a day, Assurity will potentially classify you as Preferred Tobacco.

There are other carriers that offer the Preferred Tobacco class.

Cheap Life Insurance For Cigar Smokers

Many carriers offer the best health class for occasional cigar users provided cigar users admit use on the application. Additionally, the blood specimen must show no presence of nicotine / cotinine. Users must also indicate infrequent use. If a user states infrequent use, but the blood sample shows cotinine / nicotine, that’s a problem. The problem is then transformed into a Tobacco rating.

You don’t want that, right?

Here’s a list of carriers, as of this writing, that will insure the occasional cigar user with corresponding usage. The best class is usually available unless indicated. Again, you must show a negative marker for nicotine / cotinine unless indicated.

Cheap Life Insurance For Smokeless, Chew Tobacco, Dip Users

I’ve had people who chew tell me this:

“John. I don’t smoke. I dip. Why am I charged a higher life insurance premium?”

Well, although you don’t smoke, you chew. And, chew/smokeless tobacco still contains nicotine which is bad for your health.

Most carriers will rate chew, dip, and smokeless tobacco users as a tobacco user. However, there are a handful of carriers that won’t. You have to admit usage on the application, of course. Here are their parameters, subject to change.

Cheap Life Insurance For Marijuana Smokers And Users

If you smoke or use marijuana, you’ll likely have more options than if you smoke cigarettes.

Just like tobacco use, marijuana use and life insurance depend on the carriers. Some carriers are lenient with marijuana users and others are not.

The process is really no different. The carrier looks at your overall situation. You need to admit use and frequency on the application. Instead of looking for cotinine, the carrier looks for THC in your urine and blood. If your samples come back negative (and presumably, you are aligned with the correct carrier), best class is likely available.

We address marijuana use and life insurance in a separate article. It goes into much more detail.

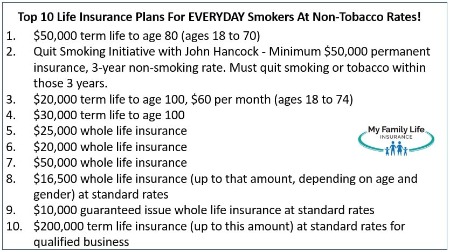

10 Best, Cheapest Life Insurance Options For Smokers, Tobacco Users, At Non-Tobacco Rates

We have helped many tobacco users and smokers obtain life insurance at non-tobacco life insurance rates. We already went through some options above, but here are additional life insurance options. Remember, we work with many favorable life insurance carriers that offer life insurance at affordable tobacco rates.

The options below are not available in every state. Contact us to learn more.

- $50,000 term life to age 80 (ages 18 to 70)

- Quit Smoking Initiative with John Hancock – Minimum $50,000 permanent insurance, 3-year non-smoking rate. Must quit smoking or tobacco within those 3 years.

- $20,000 term life to age 100, $60 per month (ages 18 to 74)

- $30,000 term life to age 100

- $25,000 whole life insurance

- $20,000 whole life insurance

- $50,000 whole life insurance

- $16,500 whole life insurance (up to that amount, depending on age and gender) at standard rates

- $10,000 guaranteed issue whole life insurance at standard rates

- $200,000 term life insurance (up to this amount) at standard rates for qualified business owners

If you just want to apply with a favorable life insurance carrier, then here is a strategy you can use to ultimately obtain non-tobacco life insurance rates.

How Smokers Can Obtain Cheap Non-Smoker Life Insurance Rates

We identified 10 life insurance options that will insure tobacco users at non-tobacco life insurance rates.

While that is great; however, if you want a high death benefit, then you will have to apply with life insurers that recognize tobacco use.

There’s no way around it.

So, if you are wondering how smokers or tobacco users can obtain non-smoker life insurance rates with higher death benefits (with the exception of the life insurance options we discussed before), there is one tried-and-true way to do so:

Quit.

That is right. I know you’ve heard this before. However, there is no game or hidden secret. Life insurance companies have ways of knowing if you smoke, use tobacco, or not.

We know it is hard as we have had many friends and family struggle to quit. It’s easy for us to say, right? Let’s talk about quitting in more detail. There are some specific strategies you can implement while trying to quit. Many of these life insurance options work together.

Strategy 1 – Apply Now

There is no better time to apply for life insurance than this moment right now. Why? You don’t know when you will die, and any life insurance is better than none at all. So, apply. We will find you the best life insurance plan for your situation.

If you are trying to quit or are healthy now (other than smoking) you will then qualify for nonsmoker rates once you do quit. Yes, it is true – most life insurance companies will “convert” your smoking status into a non-smoking status upon quitting. (Remember, you have to be tobacco-free for 12 months.)

You will have to provide a urine sample, but that is usually all that is needed. Your new non-smoker rate would then be based on your age upon quitting. For example, if you are a smoker at age 40 and officially quit at age 43, your rate will reflect a non-smoker rating at age 43.

And, just look at those premium graphs above. Once you do quit, you’ll enjoy much cheaper and lower life insurance rates.

Strategy 2 – Transfer To The Patch/Gum

This is harder than it sounds. We know. However, many carriers will allow a non-smoker status for people who use the patch or gum.

If you reduce your cigarette smoking to less than 24 per year (classified as occasional use) and use the patch or gum, you may qualify for a non smoker rate with some carriers.

Better yet, just skip the cigarettes and go right to the patch or gum. Some carriers will then qualify you for non-smoker rates if you have not smoked. Remember, though, you have to be cigarette-free for 12 months.

Additionally, you can apply with carriers that have a “quit smoking initiative” like John Hancock.

Contact us to learn more.

Strategy 3 – If You Quit, Resubmit

As we mentioned in strategy #1, if you quit, resubmit your application. You will receive a non-smoker classification upon verification of quitting.

Moreover, if you are dead set on quitting, there is a strategy that could work and potentially save you money. You would apply for a 10-year term as a smoker. All things being equal, a 10-year term policy is less expensive than a 20 or 30-year term. You have 10 years to quit and get healthy. Once you quit, you can reapply for a longer-term or better coverage.

If your health deteriorates before the term expiration, most term policies have a conversion privilege where you can convert your term policy into a permanent policy. While we are not everyday advocates of permanent policies, we are advocates of using permanent policies in your best interest. Converting your policy to a permanent policy will guarantee you will have some life insurance coverage for your surviving family upon your death.

Again, this strategy is for those who are dead set on quitting and can obtain a better non-smoking status.

Smoking vs Non-Smoking Life Insurance FAQs

Because of the detailed information in this article, we created a smoking versus non-smoking FAQ section to answer some common questions.

I quit smoking 3 months ago, do I qualify as a non-smoker?

No, you are still considered a smoker. Nearly all carriers classify a smoker as someone who has smoked within a year, even if you quit within a year. You generally need to be nicotine-free for a year. If you quit and transfer to a patch/gum or some other more favorable product, you still have to stop smoking for at least a year.

I don’t smoke, but I use a patch and sometimes chew nicotine gum. Am I classified as a smoker?

It depends on the carrier. Some carriers classify you as a non-smoker while others as a smoker.

I’m an occasional smoker, smoking a few cigarettes throughout the year, just in celebratory social situations. Am I classified as a smoker?

It depends on the carrier. As we stated earlier, some carriers classify you as a non-smoker while others as a smoker / tobacco user.

This is why an independent agency like My Family Life Insurance is needed. We can help find the right, and lowest cost, coverage for your specific situation.

What is cotinine? Why is it important to know?

Cotinine is a chemical found in tobacco and is the primary marker to determine tobacco use. While nicotine can dissipate within a few days in your system, cotinine can remain in your system much longer – for up to several months. Cotinine is a much more accurate measure of your nicotine usage.

How long does nicotine stay in your system?

Nicotine can remain in your system – in your blood, urine, or saliva – for a few days up to a couple of weeks or even a couple of months. The actual timeframe depends on you, how much you smoke(d), and your overall health factors.

How long does cotinine stay in your system?

Cotinine can stay in your blood, urine, or saliva for much longer. For example, while nicotine may show in your blood for 1 to 3 days, cotinine can remain for up to 4 days or longer. This is why many insurance companies use cotinine tests to determine any tobacco use as well.

I’d like to flush out any detection of nicotine or cotinine from my system. What is the best way to do that?

We are not health experts. However, the best way is to stop smoking. Then, to exercise and hydrate yourself. This link provides some useful information on ridding your system, including staying away from coffee and eating green vegetables.

How do life insurance companies define smokers?

A smoker is someone who smokes and has a positive nicotine or cotinine test. Note: People who occasionally smoke or smoke a pipe may qualify for nonsmoker life insurance rates if certain provisions are met. People who chew or use the gum or patch may qualify for non-smoker rates as well.

Is there nicotine in cigars?

Yes, nicotine, and therefore cotinine, exists in cigars.

What is the definition of occasional smoking?

From a life insurance perspective, occasional cigarette smoking is having fewer than 24 cigarettes in a year. If you are an occasional smoker, contact us. We likely can get you life insurance at non-tobacco rates.

How large is the difference in life insurance rates for smokers versus non smokers?

Huge. Let’s compare the rates for a 40-year-old male with standard health on a 20-year term policy for $500,000. His tobacco / smoker rate is $180 per month versus a non tobacco / non smoker rate of $60 per month! That is a difference of $120 per month or $28,800 over the 20 years!! What can you do with this kind of money??

Remember, since we at My Family Life Insurance are independent agents, we can find the right policy for your situation.

Why is the smokers rate for life insurance so much higher?

A smoker has an increased risk of heart disease, cancer, respiratory diseases (e.g. COPD), and a slew of additional health problems compared to a non-smoker. That’s why smokers pay a higher rate for life insurance compared to non-smokers. According to the CDC, a smoker is 3 times more likely to die than a person who does not smoke, all things being equal.

If I use a celebratory cigar occasionally, am I a smoker?

For most companies, if you use a cigar occasionally in celebratory and social gatherings, you are not considered a smoker. However, you generally must meet certain guidelines and your nicotine / cotinine tests must indicate occasional use or limited use.

How do life insurance companies know you are lying?

Lying on an insurance application is fraud. Moreover, the carrier can investigate through a contestability clause. If they find out otherwise, the death benefit to your beneficiaries could be reduced or denied altogether.

It is best to be honest. Carriers have ways of verifying your information. Through your blood and urine samples for the tests of nicotine and cotinine. If you opt for a non-medical policy, life insurance companies can still find out through the MIB report and/or your doctor notes.

How do life insurance companies know if you smoke?

Simple. Through your blood and urine samples for the tests of nicotine and cotinine. If you opt for a non-medical policy, life insurance companies can still find out through the MIB report and/or your doctor notes.

If I breathe in secondhand smoke, am I a tobacco user/smoker?

No. Life insurance companies do not consider secondhand smoke exposure as tobacco use.

OK. If I breathe in secondhand smoke before my medical exam, will it show nicotine and cotinine use?

No. Underwriters and testing experts agree that secondhand smoke is too weak to show up on the blood and urine tests.

However, it is a good question. I have had prospects tell me they don’t use tobacco or smoke. They then take the paramedical exam with the blood sample and urine sample. The samples come back positive for nicotine and cotinine. They then tell me (they swear) they do not smoke or use tobacco, but were subject to secondhand smoke.

The issue, as underwriters have explained to me, is the testing won’t pick up secondhand smoke. In other words, these people lied on the application. In fact, according to the underwriters I speak with, lying on the application about tobacco use is the #1 misstatement from applicants.

Burial Insurance Carriers That Cover Smokers As Non-Smokers

If you are a smoker in need of burial insurance, you have some additional options. There are tobacco “friendly” carriers that will insure you.

One is Americo. They have a “quit smoking” program where if you are tobacco-free in a consecutive 12-month period within 36 months of the policy’s start date, you will enjoy non-tobacco rates for the remaining years of the policy.

Then, we work with another carrier that will cover smokers and tobacco users as non-tobacco. However, you have limited coverage based on age. For example, a 56 year-old woman can, at most, purchase $16,500 (at the time of this writing). The premium? $54 per month – it is a premium that is hard to beat.

Finally, as we noted above, many smaller benefit whole life insurance policies exist that do not consider tobacco use. As of this writing, we helped a woman, smoker, obtain $50,000 of burial insurance at $83 per month, a non-tobacco rate.

Contact us if you would like to learn more.

Now You Know Smokers Can Obtain Cheap Life Insurance And The 10 Best Options Available

We hope you understand how smokers can obtain cheap life insurance, sometimes even at non-smoker life insurance rates. If you are a smoker and in need of life insurance, please contact us, or use the form below, so we can determine the right carrier based on your usage history.

We can and will find you the lowest cost life insurance for your specific situation.

There’s no risk to contacting us. We only work in your best interests. If we can’t help you, we can point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".