Theresa May said on Thursday she will delay legislating to implement a controversial national insurance rise for self-employed workers until the autumn, after a public rebellion by senior Conservatives, including a government minister.

The measure was a centrepiece of Philip Hammond’s first budget, which had appeared to be unravelling on Thursday, as a series of MPs voiced concern about the policy.

Speaking at a European summit in Brussels, May offered a robust defence of the policy, saying it would make the tax system “simpler, fairer and more progressive” and did not breach a Conservative manifesto pledge not to raise national insurance.

But she caved in to a demand from Tory rebels not to legislate on the issue until the autumn, when Hammond is due to deliver another budget.

The prime minister told reporters: “It won’t be part of the finance bill. That is always what happens with national insurance changes. Those elements will be brought forward in the autumn.”

That will allow the government to publish a new paper making the case for the changes; and will also come after Matthew Taylor’s report into the changing nature of the labour market, which will also look at the so-called gig economy and the self-employed, has been published.

Taylor, a former adviser to the New Labour government, is expected to recommend enhancing employment rights and social benefits for the self-employed.

May added: “People will be able to look at the government paper when we produce it showing all our changes and take a judgement in the round. Of course the chancellor and his ministers will be speaking to MPs, business people and others to listen to their concerns.”

But she insisted: “This is a change that leaves lower paid self-employed workers better off.”

The tax rise, which will take national insurance contributions for the self-employed to 10% in 2018, and then 11% in 2019, is not due to take effect until April next year. Downing Street hopes delaying the legislation will allow time for dissent to die down.

A Guardian tally of Conservative MPs known to have expressed opposition to the decision either publicly or in private found 18 who could potentially oppose it – greater than the government’s working majority of 17.

But Guto Bebb, the junior Wales Office minister who is also a whip, told BBC Radio Cymru: “I believe we should apologise. I will apologise to every voter in Wales that read the Conservative manifesto in the 2015 election.”

The former Conservative leader Iain Duncan Smith said he would like the plan reviewed at the next budget to consider issues such as the upcoming Taylor report.

“I would like to see that kept, the ball in play, because it doesn’t land until next year, so there is plenty of scope to look how this actually affects them and to listen to business representatives,” he said.

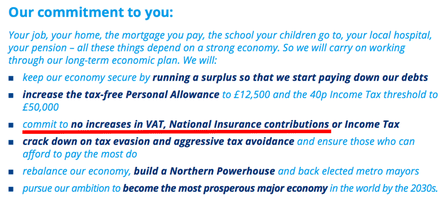

The concerns centre both on the perception that such a move unfairly targets the self-employed and entrepreneurial, and also that the 2015 Conservative manifesto specifically ruled out rises to income tax, VAT or NICs before 2020.

Defending the plan, Hammond had argued it was fair to unify the rate with that paid by employees.

Speaking on BBC1’s Breakfast show, Hammond rejected the idea he had broken a promise and said the issue was dealt with in legislation after the Tories’ election victory. “No one objected; no one raised any issues about it,” he said of the parliamentary discussions. “We regard that issue as dealt with – we dealt with it in 2015.”

A number of backbenchers went further, saying the plan, which is intended to raise an extra £1.7bn a year once it comes into force in April 2018, should be dropped or revised.

The move appeared to have placated some of the rebels. Ann-Marie Trevelyan, Conservative MP for Berwick-upon-Tweed, who had previously expressed concern about the policy, said of May’s comments “this sounds most reassuring. It will provide a rounded perspective and everyone will have the chance to consider the impacts”.

Speaking on the second day of the budget debate in the Commons on Thursday, the Harrow East MP, Bob Blackman, said the government should “look at this very, very carefully”.

He said: “There was a solemn promise in the manifesto not to increase national insurance rates. And the reality is, I worry, that the accusation could be made that it’s a bit like signing a contract but failing to look at the fine print.”

The Stevenage MP, Stephen McPartland, said: “These families and businesses are the backbone of our economy. The chancellor needs to do a U-turn and quickly.”

Other MPs to express concerns publicly included Jacob Rees-Mogg, Anna Soubry, Bob Neill, Dominic Raab, Andrew Murrison, Tom Tugendhat, Nigel Mills, John Redwood and Martin Vickers. At least five more, among them a cabinet minister, have indicated some opposition to the move.

Labour has promised to oppose the change, with the shadow chancellor, John McDonnell, saying: “Labour have been clear from the moment they were announced that we will oppose these tax rises on low and middle earners, as we don’t think it is laughing matter, unlike Theresa May and Philip Hammond.

“What is even more alarming is that the government didn’t stop and think before announcing such a tax hike. It should have been obvious that they would need to consult first or at least wait until after their review on self-employment had finish before announcing such drastic changes.

“As a result, millions of ordinary working families will have been made to worry, and will now be holding their breath until the government makes up their mind. Theresa May should simply show some leadership, rather than this partial u-turn - and just scrap these tax rises for low and middle earners altogether.”

Liberal Democrat leader Tim Farron said: “Kicking the can down the road is not enough. They need to axe this tax, not think people won’t notice in a few months. It’s a scandal this government thinks people are so stupid”.

May’s spokesman had earlier said the prime minister had complete confidence in Hammond, and in Bebb after his comments. Asked about the NICs measure, he said: “This is a manifesto commitment that was met.”

Comments (…)

Sign in or create your Guardian account to join the discussion