/cdn.vox-cdn.com/uploads/chorus_image/image/30922473/10307556363_e70a4db7f0_b.0.jpg)

The markets haven't been kind to Bitcoin in 2014. The currency reached a high of nearly $1,000 in January before falling to around $350 this month, a plunge of more than 60 percent. It would be easy to write Bitcoin off as a fad whose novelty has worn off.

After all, dollars seem superior in almost every respect. They're accepted everywhere, they're convenient to use, and they have a stable value. Bitcoin is an inferior currency on all three counts.

Bitcoin's detractors are making the same mistake as many Bitcoin fans

Yet it would be foolish to write Bitcoin off. The currency has had months-long slumps in the past, only to bounce back. More importantly, it's a mistake to think about Bitcoin as a new kind of currency. What makes Bitcoin potentially revolutionary is that it's the world's first completely open financial network.

History suggests that open platforms like Bitcoin often become fertile soil for innovation. Think about the internet. It didn't seem like a very practical technology in the 1980s. But it was an open platform that anyone could build on, and in the long run it proved to be really useful.

The internet succeeded because Silicon Valley have created applications that harness the internet's power while shielding users from its complexity. You don't have to be an expert on the internet's TCP/IP protocols to check Facebook on your iPhone.

Bitcoin applications can work the same way. There are already some Bitcoin applications that allow customers to make transactions over the Bitcoin network without being exposed to fluctuations in the value of Bitcoin's currency. That basic model should work for a wide variety of Bitcoin-based services, allowing the Bitcoin payment network to reach a mainstream audience.

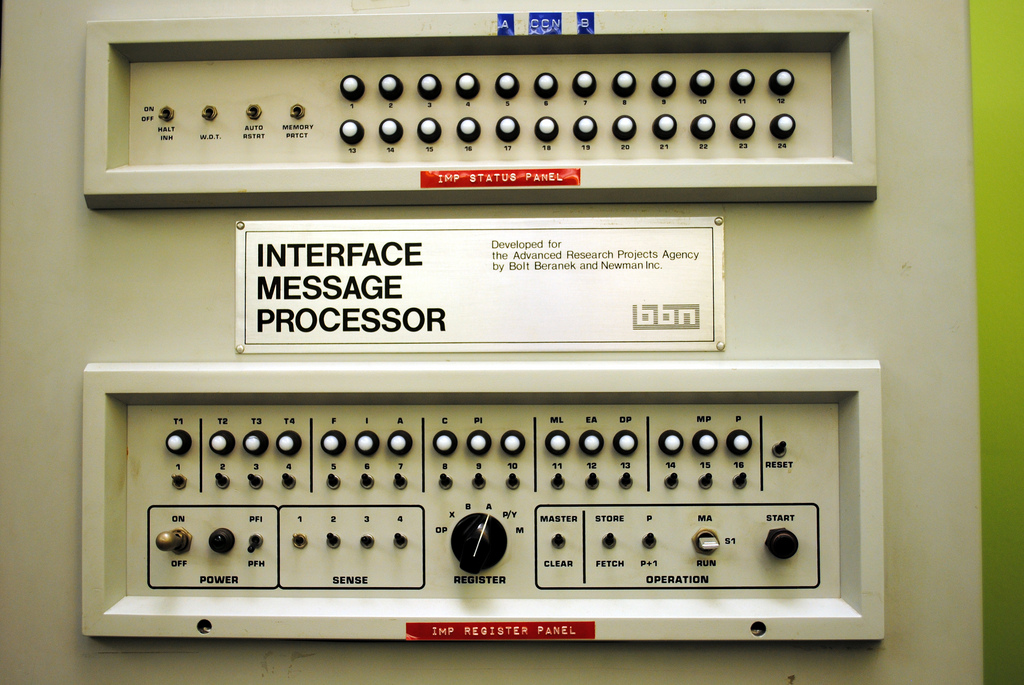

This is the very first node on the ARPANET, the predecessor to the Internet that launched in 1969. (Flickr/FastLizard4)

The first open financial network

The Bitcoin network serves the same purpose as mainstream payment networks such as Visa or Western Union. But there's an important difference. The Visa and Western Union networks are owned and operated by for-profit companies. If you want to build a business based on one of those networks, you have to get permission from the owner.

And that's not always easy. To use the Visa network, for example, you have to comply with hundreds of pages of regulations. The Visa network also has high fees, and there are some things Visa won't let you do on its network at all.

Bitcoin is different. Because no one owns or controls the network, there are no limits on how people can use it. Some people have used that freedom to do illegal things like buying drugs or gambling online. But it also means there's a low barrier to entry for building new Bitcoin-based financial services.

There's an obvious parallel to the internet. Before the internet became mainstream, the leading online services were commercial networks like Compuserve and Prodigy. The companies that ran the network decided what services would be available on them.

In contrast, the internet was designed for anyone to create new services. Tim Berners-Lee didn't need to ask anyone's permission to create the world wide web. He simply wrote the first web browser and web server and posted them online for others to download. Soon thousands of people were using the software and the web was born.

Finding Bitcoin's killer app

So what will people do with Bitcoin? It's hard to predict tomorrow's innovations, but we can get some idea of Bitcoin's potential by thinking about weaknesses of the conventional financial system.

Bitcoin is such a good deal for merchants that they may find it worthwhile to offer their customers discounts for paying with Bitcoin instead of cash or credit cards

One obvious application is international money transfers. Companies like Western Union and Moneygram can charge as much as 8 percent to transfer cash from one country to another, and transfers can take as long as 3 days to complete. In contrast, Bitcoin transactions only take about 30 minutes to clear, and Bitcoin transaction fees could be a lot less than 8 percent.

People have been building Bitcoin ATMs to let people convert between bitcoins and their local currency. The first Bitcoin ATM was launched a little over a year ago. Today, there are 329 of them.

If these devices continue to proliferate, they could become a useful alternative to conventional money-transfer services. Currently, each machine charges a transaction fee of around 3 percent, so the total cost of transferring money from one Bitcoin ATM to another is around 6 percent. That's comparable to the fees charged by incumbent money transfer services, and competition is likely to push down Bitcoin ATM fees over time.

A more ambitious application for Bitcoin would be as an alternative to credit cards for daily purchases. Startups such Bitpay have already figured out how to make Bitcoin attractive to merchants as a way of accepting payments. Credit card networks charge merchants around 3 percent to process transactions. Bitpay charges 1 percent or less to accept Bitcoin payments on behalf of merchants. Bitpay merchants don't have to worry about the headache of disputed payments known as "chargebacks."

Of course, for Bitcoin to take off as an alternative to credit cards, consumers will have to start using them regularly. And that's going to be a hard sell, especially if consumers are exposed to the risk of Bitcoin's volatility.

But a Bitcoin-based payment app could also have some advantages. One is security. The current credit card network essentially works on the honor system, allowing any merchant to charge a credit card and relying on after-the-fact adjudication to police fraud. Bitcoin could allow companies to experiment with alternative approaches that build in security at the front end, for example by asking users to confirm a transaction on their smartphones before it's approved. That could cut fraud, reducing the hassle of disputing fraudulent payments and allowing lower fees.

Moreover, Bitcoin is such a good deal for merchants that they may find it worthwhile to offer their customers discounts for paying with Bitcoin instead of cash or credit cards. That might entice bargain-hunting consumers who aren't otherwise interested in trying a new payment technology.

Using Bitcoin-the-network without Bitcoin-the-currency

The biggest stumbling block for many Bitcoin services is Bitcoin's volatility. The current generation of Bitcoin "wallet" apps, which store bitcoins on behalf of users, expose consumers to fluctuations in Bitcoin's value. Ordinary consumers are unlikely to ever be comfortable with a payment system where their wealth can shrink by 10 percent or more in a single day.

Fortunately, it's possible to design Bitcoin-based financial services that don't expose users to fluctuations in Bitcoin's value. Bitpay is a good example. Bitpay merchants set prices in conventional currencies such as the dollar, converting to the equivalent number of Bitcoins at the time of sale. Once the sale is made, Bitpay immediately converts it to an equivalent number of dollars and deposits the cash in the merchant's conventional bank account. This means that from the merchant's perspective, Bitpay is just another way of accepting dollars. A Bitpay merchant isn't affected at all by fluctuations in the value of Bitcoin.

The same principle could apply to any other Bitcoin-based service. A consumer-friendly payments app could store a user's cash in dollars, converting them to bitcoins at the time of payment. Under the hood the app could use the full power of the Bitcoin platform, but from the user's perspective it would just seem like another way of paying for things with dollars.

You're probably wondering: if Bitcoin's value is as a payment network, why not just build an open payment network based on a conventional currency like the dollar? An open, dollar-based payment network would be a great idea. The problem is that no one has figured out how to build one.

Dollars in the Paypal network are worth a dollar because the Paypal company has promised to honor withdrawal requests. But there's no organization to perform this role on a peer-to-peer network like Bitcoin.

Suppose there were a network called Dollarcoin that worked exactly like Bitcoin except a company called Dollarcoin Inc. promised to convert dollarcoins into dollars. Then the value of one dollarcoin would always equal one dollar. But as the manager of the Dollarcoin network, the Dollarcoin company would face pressure to comply with a variety of laws regarding fraud, money laundering, and so forth. To keep the costs of complying with those requirements under control, it would be forced to regulate who could use the network and how. (Indeed, that's exactly what happened to Paypal 15 years ago.) Over time, the Dollarcoin network could become as restrictive as conventional financial networks.

Bitcoin's openness depends on the fact that no one owns the network. And with no owner, there's no one to guarantee that bitcoins have a predictable value.

Many of Bitcoin's early adopters were acolytes of Ron Paul's brand of hard-money libertarianism. They were attracted to the promise of a currency whose supply was outside of state control, and as a consequence, Bitcoin has gained a reputation as the second coming of the gold standard. That, in turn, has made mainstream economists who are hostile to Ron Paul and the gold standard hostile to Bitcoin.

But in reality, the case for Bitcoin simply doesn't have much to do with its unorthodox monetary policy. Bitcoin is a payment network that happens to have its own currency, not the other way around. It's worth taking seriously whether or not you agree with Ron Paul's views on the Federal Reserve.