The Tesla Effect: How Tesla Is Changing the Used Car Game

Tesla’s sales successes are wreaking havoc on the pre-owned luxury car market

Tesla

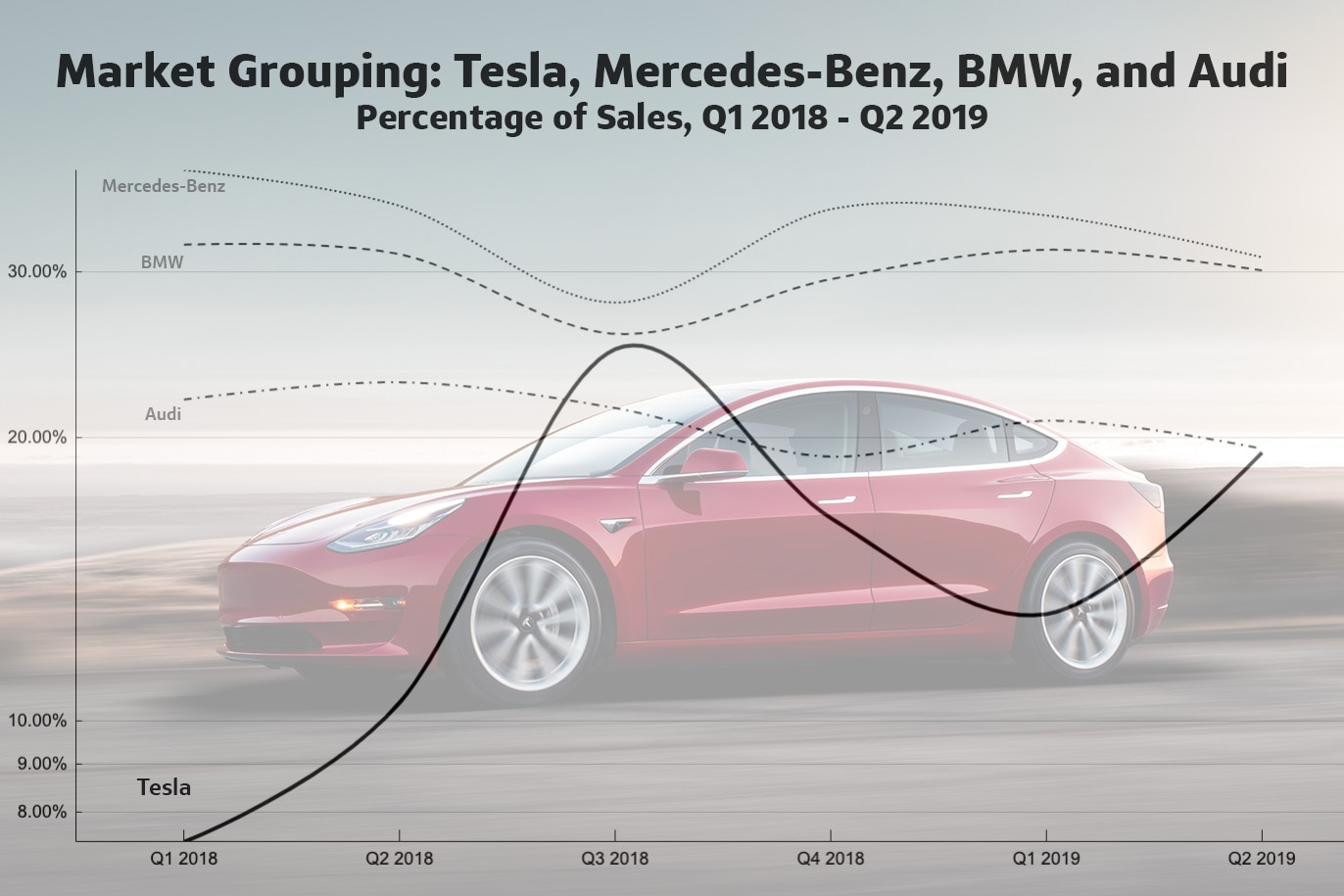

Automotive luxury, as it exists today, is rapidly becoming the escape of driving in and of itself. The decisions car-buyers make are increasingly on the side of technology—or more specifically, Tesla’s version of it—than the traditional luxury cars that have long been industry benchmarks. What does that mean? Tesla’s sales successes are wreaking havoc on the pre-owned luxury car market. Once-strong demand for European luxury brands like Mercedes, Audi, and BMW is evaporating as buyers that used to spring for premium luxury sedans now want a Tesla. Any Tesla.

Even in the used market, that can be incredibly hard to find if you’re on a budget.

In particular, Tesla’s Model 3 went from zero to over 140,000 units faster than any other luxury vehicle had before, and the demand for new Teslas is, in a very real sense, driving the used car market. With buyer after buyer trading in a still new-ish luxury vehicle for a brand-new Tesla, traditional luxury brands appear to be traded-in more frequently than all American and Korean manufacturers combined.

Photo: Tesla

Overlay based on data from ADESA.com

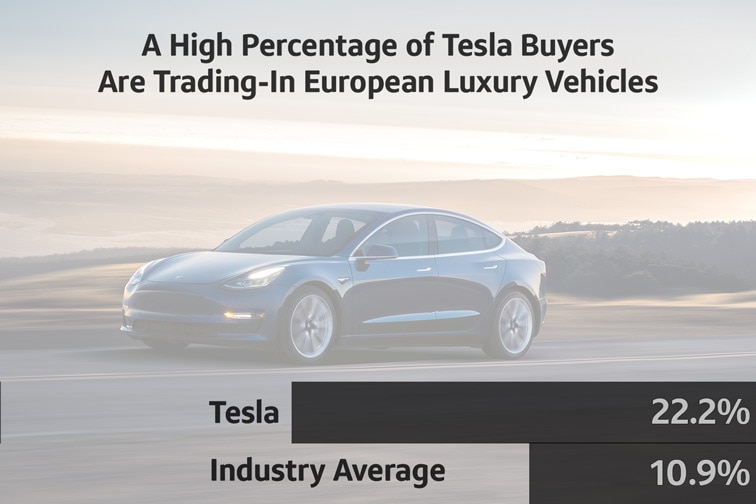

Tesla now gets European vehicles as trade-ins 22.2% of the time—more than double the industry average of 10.9%. Because of this uptick, the market is becoming flooded with more affordable cars from Mercedes, Audi, BMW and the like—without a corresponding increase in demand.

We’re calling this The Tesla Effect. It’s strong enough to cause prices to plummet, because the market has an excess supply of used luxury cars.

A Rough Road Ahead For Once-Dominant Luxury Brands

Used car wholesalers like Manheim Auctions let thousands of dealers bid simultaneously on cars. Think of them as the New York Stock Exchange of the used car market. We took a deeper dive into the Manheim Market Report, which is a used-car database that tracks the wholesale price of millions of vehicles throughout the country as they’re bought and sold.

The data shows exactly how rough the recent road has been for the once-dominant luxury marques. In the first six months of 2019 alone, a 2018 BMW 320i lost nearly 20% of its value, dropping from $37,700 to $30,700.* While it’s true that newer vehicles typically depreciate at a steeper rate, it’s not usually that steep. But again, The Tesla Effect is changing the norm. At three years old, a 2016 Mercedes B-Class would ordinarily depreciate at a slower rate. For the same time period as the BMW above, though, the B-Class dropped from $18,500 to $13,250, nearly 30%.*

*Source: Manheim Market Report

This is where The Tesla Effect impacts you. The steep drop is great news if you’re in the market for a late-model luxury car, because that deprecation will work in your favor. You can now conceivably get a really nice three-year-old Mercedes C-Class or BMW 3-Series at a lower price than a brand new Toyota Camry or Honda Accord.

Tesla is the Shiny, New, High-Tech Face of the World of Luxury

Photo: Tesla

Overlay based on sales data from the respective manufacturers

As the numbers bear out, speed and comfort are taking a back seat to emerging technologies that are quickly transforming luxury cars into self-driving tools for their owners. The base Model 3 with Autopilot now retails for just under $40,000 brand new. Unlike the luxury cars listed above, nearly every Model 3 sold today has self-driving software that allows the car to automatically change lanes and even be summoned out of a garage or parking space. Luxury through a Tesla lens is in the car’s ability to take over some of the more boring aspects of driving.

The Tesla Model 3’s combination of semi-autonomous (self-driving) technology, quicker acceleration than a BMW 3-series, and energy efficiency that blows away a Toyota Prius, has quickly created a seismic change in today’s luxury car market. As a result, if you’re planning to buy a late-model (non-Tesla) luxury car in the near future, you’re letting someone else take a brutal hit in depreciation and getting a great car for relatively little money—much less than if you bought new, anyway. It can be a vicious cycle, but it can also mean a great deal for you.