In part 1 of our series, we discussed the motivation and framework behind measuring the environmental cost of a payment transaction. We also talked about the methodology for credit card networks. In this post, we continue to cover the environmental impact model for Cryptocurrencies and paper money.

Cryptocurrencies

In order to have a mathematical model to determine which ASIC mining rig models are used in a rolling time frame, we must make a few assumptions:

- As long as a model can guarantee profitability in electrical terms, it will be used. This means the cost of electricity for running the machine must be less than the Bitcoin rewards (adopted from CBECI model).

- Among profitable models, miners prefer those that are more cost efficient (a mining rig could range $1,500 to $6,000 and have various performance levels).

The final model calculates a weighted-average rig efficiency and it’s applied to the Bitcoin network’s overall hashrate for daily power consumption estimation. For Ethereum, we could use the same framework with two main differences: Ethereum mining hardware is Graphic Processing Units (GPUs) and we use major GPU manufacturer market shares to determine which GPUs are used for mining.

Paper money

Does it cost anything for me to hand you a dollar? Not really. Lacking existing relevant literature, calculating how much electricity a cash transaction costs seemed both daunting and farfetched. But using a bottom-up problem solving framework, we were able to figure out a reasonable and defensible methodology after diving deep into the operating system of cash.

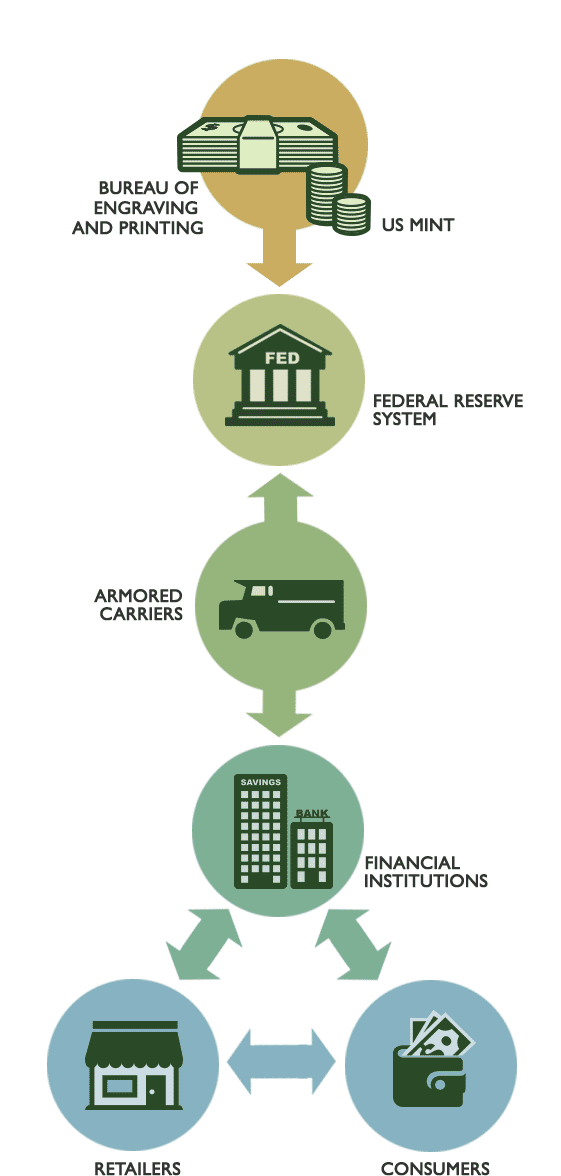

The environmental cost of enabling paper money transactions lies in maintaining the entire cash system. It goes from sourcing materials for money printing to circulating the cash flow to waste disposal. Money printing and ATMs are two major sources of electricity consumption throughout a dollar bill’s lifecycle. We estimated the combined electricity consumed using money printing order data from the Bureau of Engraving and Printing bill manufacturer and energy specifications of ATM machine models.

All other subsystems within a bill’s lifecycle do consume electricity; however, they present different forms of environmental impact in far greater magnitudes than carbon emissions from electricity. We gathered research on those topics, and made sure to highlight them in our official paper, e.g. eutrophication, photochemical ozone creation, human toxicity.

One interesting challenge remains—how many cash transactions are there? It’s reasonable to assume that cash is disproportionately used for small-value transactions and its usage varies by age and income. Therefore, we weighed the US Census data with cash preferences and transaction frequencies per age group to arrive at 36 billion transactions in a year (roughly one in six transactions combined with non-cash payments).

After producing the data, we worked closely with our Engineering and Design team to turn the numbers into an interactive and beautiful experience for users visiting our website. A special thank you to Max Krause for helping review our work and providing thought leadership in Crypto environmental sustainability issues research, and to students at the National University of Singapore for furthering our research with blockchain adoption and sustainability forecasts.

There will be much ongoing work for us to reach carbon-zero, and we look forward to more diverse and deeper research addressing the environmental implications of our day-to-day choices, such as how we pay. And most of all, we look forward to you helping us spread awareness and take real actions to protect our world.

If you’d like to help create a green digital financial future, join our team!