Rickards: Fed Won’t Raise Rates in 2015 (Video)

Since Janet Yellen’s Federal Reserve has put an end to quantitative easing, the financial media generally believes the United States economy is improving. With an improving economy, the expectation is that Yellen will begin to raise interest rates in 2015. So goes the argument against an improvement in the gold market.

However, many analysts aren’t so optimistic about the state of the economy and haven’t given up on gold yet. In this video, Jim Rickards explains to CNBC why he thinks the US is in the same depression that began in 2007. Even Yellen can’t run from this reality, so Rickards argues that the Fed will be unable to raise rates in 2015.

Highlights from the interview:

“When all is said and done, 2014 as a whole is going to be the same kind of 1.9, 2% growth we’ve seen for five years. In other words, we’re still in the same depression that we’ve been in since 2007. A depression doesn’t mean continuous falling GDP. It just means GDP below trend. If trend is 3.5, we’re just growing 2%, maybe 1.9. So it’s the same poor growth we’ve seen for a long time. The Fed can’t tighten into the face of that. We all know what’s going on with labor force participation.

“So the US economy is not necessarily sinking into a recession, but it’s fundamentally weak. Certainly too weak to support a rate increase. And the dollar getting stronger – that’s the same as a rate increase. There’s a lot of tightening going on and a weak economy…

“The thing [Yellen] watches the most are real wages, and they’re going nowhere. Of course, labor force participation is very close to its lowest level in almost 40 years.

“You said that the Fed has a dual mandate: price stability and employment. Sometimes those two things are in conflict. Janet Yellen said right now they’re a little bit more worried about employment than they are about prices. But real wages are where those two things come together. If the labor market is tight, labor can demand a raise. It’s going to show up in real wages. We’re not seeing that…

“So real wages flat, labor force participation near all-time lows. That’s a weak labor market…

“The US economy isn’t collapsing. It isn’t imploding, but it’s not growing anywhere near trend. It’s that same 2% growth. The same growth that caused [the Fed] to go to zero [percent interest rates] in the first place still prevails…

“There’s nothing monetary policy can do about it. You can’t fix a depression with liquidity. You can only do it with structural changes.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

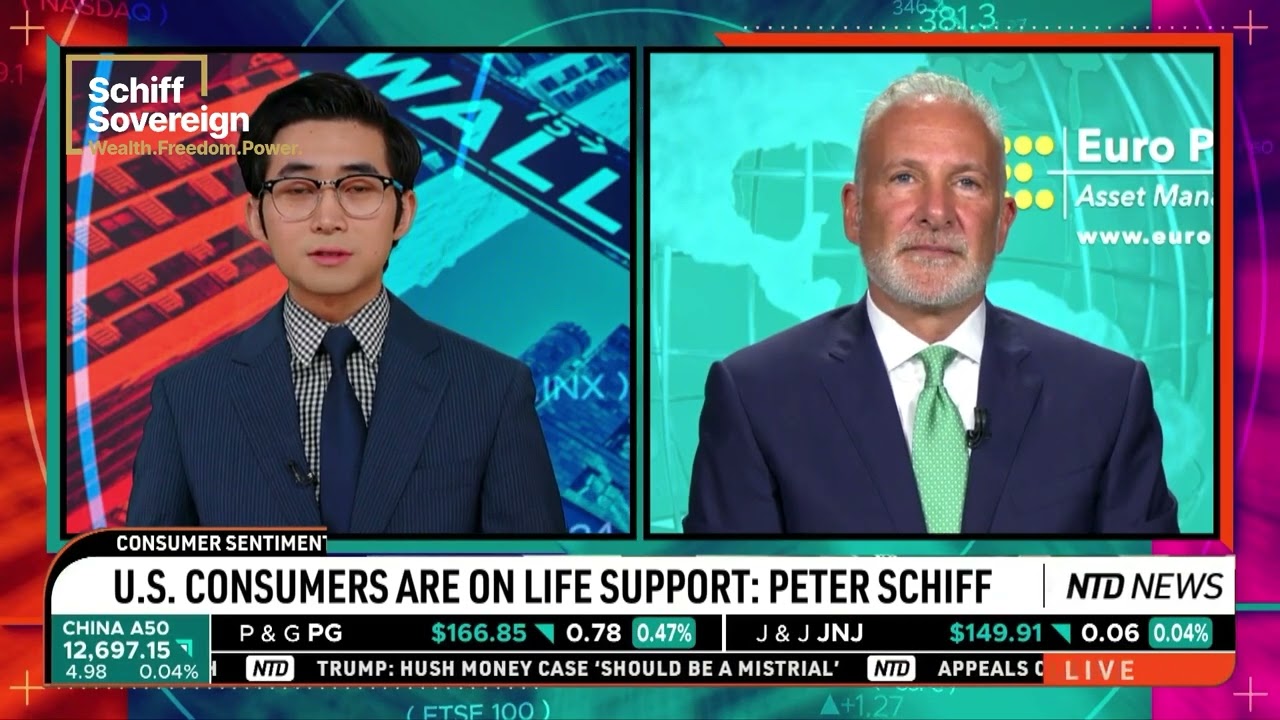

On Friday, Don Ma interviewed Peter on NTD’s Business Matters. Their conversation focuses on declining consumer sentiment. With GDP and unemployment figures also signaling a recession, a worsening consumer outlook bodes poorly for the economy.

On Friday, Don Ma interviewed Peter on NTD’s Business Matters. Their conversation focuses on declining consumer sentiment. With GDP and unemployment figures also signaling a recession, a worsening consumer outlook bodes poorly for the economy. While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […]

While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […] On Wednesday, Peter appeared on This Week in Mining with Jay Martin. Jay and Peter discuss the state of the economy, the government’s assault on sound money, and why the mining sector constitutes a good investment.

On Wednesday, Peter appeared on This Week in Mining with Jay Martin. Jay and Peter discuss the state of the economy, the government’s assault on sound money, and why the mining sector constitutes a good investment. On Friday, Peter participated in an exhilarating debate over the merits of gold and Bitcoin. Professor of economics Nouriel Rabini joined Peter to debate Erik Voorhees and Anthony Scaramucci, two proponents of Bitcoin. They cover a lot of ground in their 2+ hour debate, so be sure to watch the full video on Peter’s youtube channel.

On Friday, Peter participated in an exhilarating debate over the merits of gold and Bitcoin. Professor of economics Nouriel Rabini joined Peter to debate Erik Voorhees and Anthony Scaramucci, two proponents of Bitcoin. They cover a lot of ground in their 2+ hour debate, so be sure to watch the full video on Peter’s youtube channel. In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […]

In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […]

Leave a Reply