Regardless of platform, social media is a space designed for people to talk with each other. But if one truth exists in social media, it’s that it’s the brands keeping the lights on. And brands need to understand the full picture of what people think about them. That means on and off social.

More critically, not just what they think, but what they feel and how they respond to a brand’s content, and especially, what they say and share.

In order to do that, brands must incorporate and process the full breadth of the unstructured text data they own, supplement it with trends and search data, and give structure and meaning to the questions executives ask every day.

What is a data lake?

A data lake is, much like a regular lake for a holiday, a place to go. It’s not actually wet, though you truly can swim in it for insights. The key thing about a data lake, that makes it different from a data warehouse or just a dataset on it’s own, is that it’s queryable.

Feed your data lake with these conversation trends

When you combine the ability to query and visualize across the owned data from business transactions, the earned data from somewhere like social media, and external data from the stock market for example, key decision makers are now able to access data-backed answers to their questions, even if those questions shift daily.

Why does my organization need a data lake?

Any organization that frequently searches for insights to gain a competitive advantage can use what their data lake generates to get ahead. The value of the data lake or the data therein doesn’t come from its existence of course. The value comes from the democratization of the data, from the ability for anyone to generate insights. Removing data silos and adopting a customer data integration strategy is one of the most important benefits of a data lake.

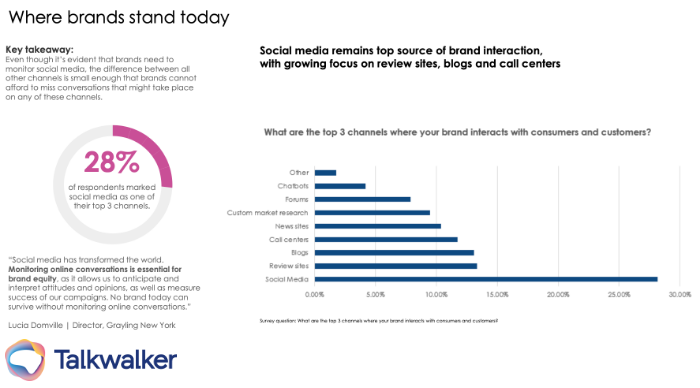

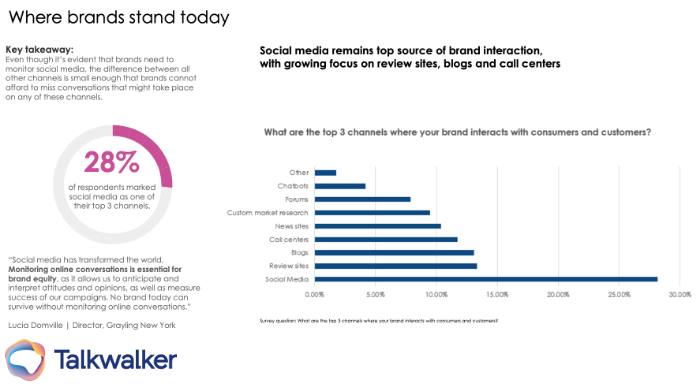

Social media remains the most common place for brands to interact with their consumers.

For that, brands need 3 things:

-

Smart analysts capable of interpreting the figures they see in front of them.

-

Strong processes in place on an organizational level, that ensure these analytical voices are heard, and their advice followed.

-

Executives and decision makers who ask the right questions, to the analysts who ask it, to the data.

Oh, and a fourth would be a data lake itself. Fed and nurtured from multiple sources, the data lake architecture should ensure unstructured data can be easily visualized and accessed by all who need it.

How can I build my own data lake?

Your brand is probably already sitting on multiple datasets and sources from which to feed your data lake. You’ll need a place to store and query all these data sources, but first you’ll have to find them, and they could be scattered across multiple departments.

After you decide on a budget and where to source your data lake, you’ll want to ensure two things.

First, that you are feeding your data lake with unstructured data. This could be your call logs, converted to text files. It could be survey results. It could be email replies. It could be employee reviews on hiring sites like Glassdoor.

The above brands are closely associated with Bitcoin, capturing more conversation around the cryptocurrency than others.

Ideally, you’ll pull from anywhere and everywhere that can give you the insights you need. Supplement this data with external data like search trends from Google, stock pricing, or social listening results.

Secondly, implement strong structures so that what the data is telling your analyst is received by your executives who can properly contextualize it, and make strong decisions backed by the data.

That requires a level of data maturity and data democratization that many brands, by their own recognition, don’t listen to enough. We’re talking about something more akin to an intelligence product.

Scrubbed and analyzed before presented to the requestors of the intelligence, the analysts are producing a finished product that is meant to be consumed by key decision makers. For spy agencies that means secret agents and covert drops. For brands, it means business intelligence, or more accurately, consumer intelligence.

Consumer intelligence

Consumer intelligence is a brand’s insights, composed of data from three core areas of interaction with their consumers:

Consumer Research: Talking to your brand

Brands must first gain a strong understanding of their market, and the best place to start is with rigorous consumer research. Consumer research can be overwhelming if you don’t know where to start, but fortunately lots of datasets and tools exist to make this process easier.

Whether it’s getting potential buyers to respond to surveys, building on data gathered by other organizations that’s available publicly, or combing market data to uncover hidden opportunities, there’s no substitute for deep research.

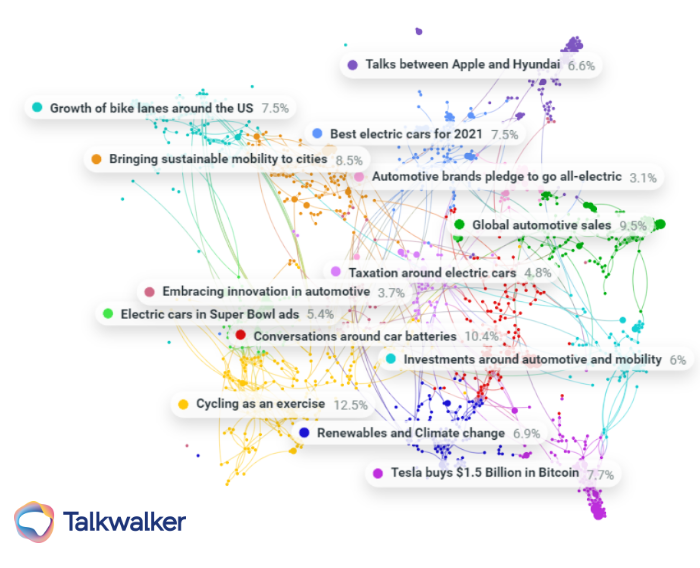

Sustainable mobility conversations in the US show that electric cars, bike lanes, and batteries are amongst the most discussed topics.

After the research tells you where to deploy your resources, it’s time to build a strategy.

Customer experience: Talking with your brand

The customer experience is the best place to make your brand stand out. Make it memorable, and you’ll have repeat customers banging down your door to experience that feeling again and again.

Reply with three emojis and we’ll tell you which Lay’s matches your vibe.

— LAY'S (@LAYS) March 3, 2021

No amount of numbers or data will ever be a substitute for a winning creative strategy, but once you’ve identified that, a brand can use those numbers to fine-tune and polish the strategy.

Social proof is a powerful influencer, and reviews can make or break a purchasing decision. Brands must maintain a handle on myriad review sites, and respond quickly and transparently to reviews that need attention.

While a single review alone can decide a purchase, at the brand level it’s important to view these reviews holistically, or as the sum of their parts. Review tracking and analysis can unveil common pain points in the customer experience, as well as easy ways to replicate the things people love.

Social listening: Talking about your brand

Social media analytics are the entry point for any brand that needs to get a pulse of their market, and quickly. Brands can monitor for mentions of themselves, their rivals, and customers who are unhappy, or looking to buy. Social listening takes these mentions, and helps strategists and analysts develop insights that they can apply to social.

The trends in consumer conversation, uncovered.

The difference between social media listening and social media monitoring, and where we’re going now, is that brands don’t exist exclusively on social, and nor do they exist that way in the customer’s mind.

It’s time for brands to take the full view of customer conversation. With the brand, about the brand, to the brand, and let the various components grow and inform each other in the brand’s data lake. From here, smart analysts and strategists can start to discern that voice of the customer.

Voice of the Customer: Find it, hear it, reward it.

Through a combination of these sources, and by asking the right questions, a brand can start to hear and understand, then parrot and reward the Voice of the Customer.

Find out more about the Voice of the Customer across key industries, and how to use your data to extract the VoC for your brand with our latest report, the State of Conversation.