A Stormy October, but Not for Gold

Is the world waking up to the economic reality Peter Schiff has been warning about all year long? With the current chaos in the stock market and rise in the price of gold, mainstream commentators and economists around the world are starting to wonder if stocks really are in bubble territory. All sorts of technical indicators are driving speculative investors to seek the safe-haven of gold. Take a look at some of these ominous indicators highlighted by the Economic Collapse Blog:

- The S&P 500 and Nasdaq Composite experienced the worst three-day decline since 2011.

- The price of oil is plummeting, which happened just before the 2008 financial crisis. Oil hasn’t been this cheap for two years.

- The Volatility Index (VIX) is at its highest since the European debt crisis, indicating a lots and lots of fear on Wall Street.

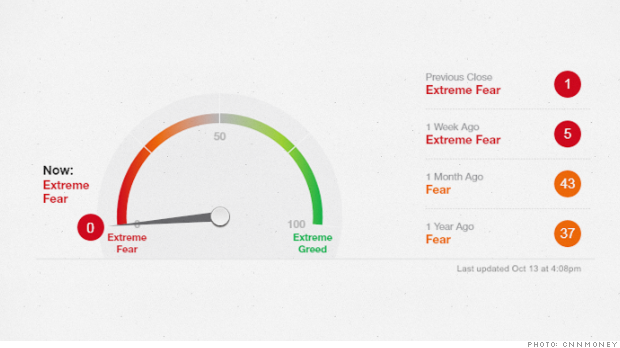

On Monday, CNN’s Fear & Greed Index hit zero, a level it hasn’t touched since 2011, right after Standard & Poor’s downgraded US debt.

Meanwhile, compare this to gold. As of yesterday, the yellow metal has experienced it longest rally in two months, erasing all of its previous losses. At a current price of about $1241, gold is now up almost 4% since 2013. The S&P, on the other hand, is up only 1.4%.

Technical comparisons aren’t the only thing bolstering the case for gold this season. The Telegraph reported last month that the “super-rich” are have been rushing to stockpile large, 12.5 kilogram gold bullion bars. That’s more than 27 pounds and millions of dollars worth of gold in a single bar! Here’s some details from the article:

The sales of 1kg gold bars, worth about £25,000 each, has doubled during the three months ended August, when compared to the same period last year, according to ATS Bullion sales figures. Sales of the more popular gold coins such as the quarter ounce sovereign and one ounce Krugerrand have also doubled this year, according to figures from BullionByPost.”

Perhaps the Europeans are realizing what the Chinese have always known – that in times of economic trouble, precious metals are the only reliable investment.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Leave a Reply