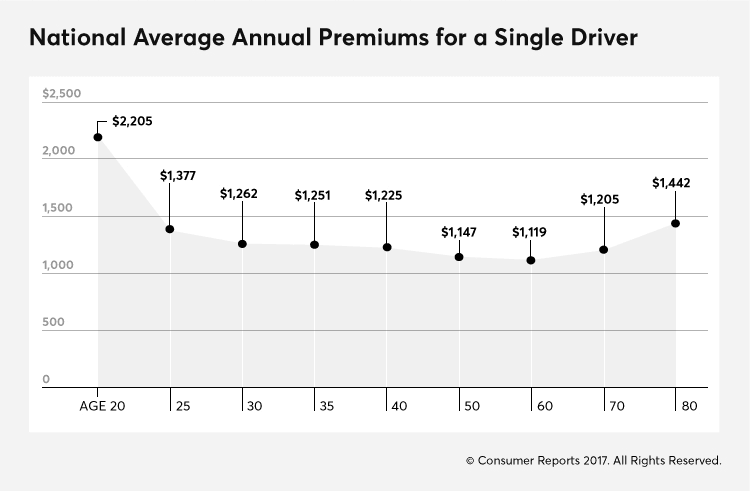

This chart shows the average annual car insurance rates over the course of a lifetime for a single driver in the U.S. In general, 20-somethings pay extra because of their inexperience, while those 60 and older pay more for their increased risk of fender-benders. But different events over your life can translate into savings or penalties. Here's what you can do to take advantage of the former and the sting out of the latter. (Car insurance rates shown are national average annual premiums for a single driver.)

25 Years Old: Get That Diploma

Drivers in their 20s are penalized for their lack of driving experience.

CR's advice: Telling your insurer about your education can help a little. College grads, on average, save about $90 per year compared with those who never finished high school. Not a lot, maybe, but over time, it can add up. Advanced degrees help even less: about $20 for a Ph.D. and $15 for a Master's.

30 Years Old: Tie the Knot

Insurers now consider you experienced, so premiums start to flatten, making it a good time to shop around for better car insurance rates. And getting married can help, too. Two people in their 30s who marry and combine policies can save an average of about $525 per year compared with what they would pay as singles.

CR's advice: This benefit is greater in some states and with some insurers. In Texas, for example, getting married is worth about $780, on average, with Geico but only $360 with State Farm.

35 Years Old: Have a Baby on Board

Trading up from a Honda Civic EX to a Honda Odyssey EX minivan can actually help you save: an average of about $240 per year for a couple with two cars and no teens. In some states, the differences can be even bigger: In Florida, that family would save about $375, on average.

CR's advice: Look for additional savings in car insurance rates by calling other carriers. A Florida driver upgrading from that Civic to the Odyssey could save, on average, about $600 by signing up with Progressive instead of Allstate, for example.

40 Years Old: Buy a House

Simply owning your own home can save a two-car couple about $110.

CR's advice: Bundling your auto coverage with homeowners insurance can save you even more: about $240, on average, for a two-car couple. Shopping around pays, too. In California, a driver combining homeowners and auto policies could save about $1,900, on average, by signing up with Geico vs. Nationwide.

50 Years Old: Hand Your Teen the Keys

Adding a teenage boy will cost a married couple about $1,740; a girl, about $1,455.

CR's advice: Comparison shopping can help. In Pennsylvania, signing up with Erie Insurance Group instead of Progressive can save you, on average, about $2,300. But don't intentionally keep your teen off the policy to save money. Lying to your insurer is fraud, and grounds for getting dropped. Instead, take advantage of good-student discounts if you can. That saves a two-car family with a teen driver an average of about $350. Good-student discounts in some states can be even bigger: over $700 in Delaware, Louisiana, and Rhode Island.

60 Year Old: Get a Midlife-Crisis Benz

Moving from a family car to a sports car or luxury vehicle may make you feel young—but also cost you: $450 for a Mercedes-Benz E350, $440 for a Chevrolet Corvette, and $250 for a Porsche Boxster, on average.

CR's advice: Once you've chosen those fancy wheels, compare coverages. An Ohio resident insuring a Mercedes E350, for instance, can save an average of about $900 with Farmers instead of Allstate.

70 Years Old: At Long Last, Retire

Insurers start raising rates after 60, in some places especially. In Texas, car insurance rates for a single driver increased far more after age 60 with Geico than with State Farm.

CR's advice: Signing up for a mature driver's ed class can save single drivers about $50, offsetting some of the costs that come with age. In most places, joining AARP won't help much. One notable exception: In California, if you sign up with The Hartford and belong to AARP, you could save about $500.

More on Car Insurance

Editor's Note: This article also appeared in the March 2017 issue of Consumer Reports magazine.