Manufacturing Bounces Back After Brexit Shock

Sterling climbs as figures show growth in the sector at a 10-month high, recovering from a post-referendum downturn in July.

Thursday 1 September 2016 11:58, UK

The UK manufacturing sector bounced back strongly in August according to better-than-expected figures that add to hopes the economy will avoid a recession.

Monthly purchasing managers' index (PMI) data from Markit showed growth in Britain's factories climbed to a 10-month high - after it had gone into reverse gear following the referendum.

It was helped by the plunge in the value of the pound since the poll making exports more attractive.

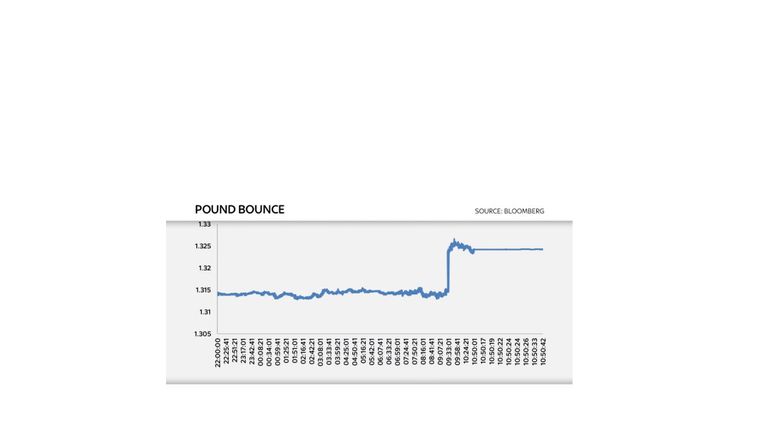

Sterling jumped by more than a cent against the US dollar after the latest figures were published.

The PMI reading of 53.3 for August - where the 50 mark separates growth from contraction - was sharply up on July's figure of 48.3.

It was the joint-biggest rebound in the nearly-25 year history of the survey.

The beleaguered manufacturing sector is still struggling to catch up following the recession eight years ago despite efforts to drive growth.

But the latest figures offered a glimmer of hope, also revealing a rise in employment for the first time in 2016.

Manufacturing is seen as a potential winner from the referendum result as the subsequent sharp fall in the value of the pound makes UK goods cheaper and more attractive for overseas buyers.

However the PMI data also showed the downside of the currency plunge, with inflation on imported raw materials rising.

David Noble, chief executive of the Chartered Institute of Procurement and Supply which compiles the survey with researchers Markit, said: "The Brexit brakes are off, as the sector surged ahead."

Paul Hollingsworth, UK economist at Capital Economics, said the figures added to evidence that the manufacturing sector "is getting over the initial shock of the referendum outcome".

He said they backed the view "that the economy is set for a period of slower growth, rather than a full-blown recession in the near term".

Separate figures have shown retail sales doing better than expected and consumer confidence recovering in the wake of the referendum, as well as an uptick in house prices.

However James Knightley of ING Bank said risks of a downturn remained later in the year.

He said the Bank of England still looked likely to cut interest rates further - after they were reduced last month to 0.25% - and that Chancellor Philip Hammond would still need to take action to loosen the Government's spending purse strings.