- Knowledge Base Categories:

- School Accounting System

- Payroll

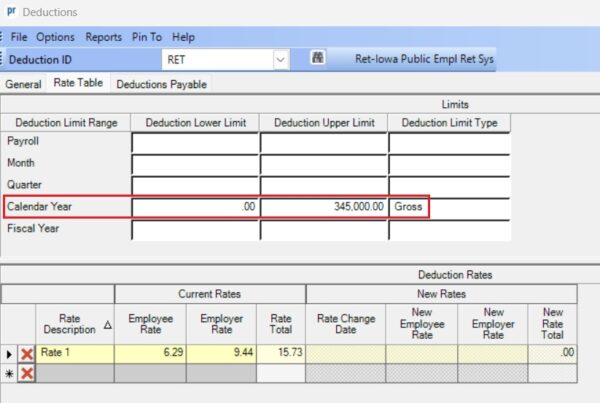

Training Tidbit: Did you update your IPERS deduction in Payroll with the new limit for 2024?

For Iowa school districts, the limit for IPERS increased to be $345,000 effective January 1, 2024.

To verify your IPERS deduction includes the correct upper limit, complete the following:

- From the Payroll screen, select the Maintenance menu, and then Deductions.

- Bring up your IPERS deductions

- Click the Rate Table tab.

- Verify 345,000 is in the Deduction Upper Limit field for Calendar Year with Gross in the Deduction Limit Type field, as shown in the print screen below.

- If needed, make the necessary changes and click the Save button.