A New Defense Innovation Base

What region is most likely to shape the military conflicts of the near future? Is it China, or the Middle East? North Korea? Maybe Russia?

Try Silicon Valley.

On today’s battlefields, the Department of Defense (DoD) must contend not only with the friction and fog of tactical engagements, but also with the complexities of a threat environment in constant technological flux. Against this backdrop, innovation fueled by commercial market forces in places like Silicon Valley has come to play an increasingly decisive role. Recognizing the opportunities and challenges of the contemporary innovation environment, the DoD Information Analysis Centers (IACs) are undertaking a new initiative called Technology Domain Awareness (TDA), which uses knowledge of the global technology commons to create a resilient defense technology enterprise that fully incorporates the high tech outputs of the commercial marketplace. In this first of three articles, we explore the underlying factors and goals underwriting the TDA mission to develop a robust defense innovation base that cooperatively aligns the non-defense research and development (R&D) marketplace with emerging defense capability needs. The second and third articles will respectively address the TDA business process and the ways in which TDA complements the defense acquisition system, leading to a more effective, efficient and adaptive defense innovation posture.

Chris Anderson’s 2006 book The Long Tail explores the diversification of consumer media stemming from the democratization of the tools of digital production and distribution. Within the media context, the availability of affordable digital content production software and low cost, Internet-based distribution and marketing has led to an explosion of niche products appealing to highly specialized tastes and interests. In the years since The Long Tail was first published, this phenomenon has grown beyond entertainment and digital, ushering a hardware revolution that has transformed private citizens into network-enabled “makers” capable of developing sophisticated commercial, consumer and even military-grade products. Today, the rapid proliferation of startups operating at the intersection of hardware and software technology is having a noticeable impact on commercial and consumer markets and has given rise to an entirely new segment of the high-tech economy, the Internet of Things (i.e. the extension of the Internet into the physical world). With this trend now attracting significant capital from venture investors and alternate financing platforms like Kickstarter, an entire class of innovators limited only by their imaginations is beginning to emerge – a development that foretells exponentially accelerating rates of technology innovation over time, or what technology futurist Ray Kurzweil has dubbed the law of accelerating returns.

Harvard Business School professor Clayton Christensen postulates that innovation and disruption are two halves of the same coin. Successful organizations continuously map technology innovations to the competitive landscape, eschewing preconceived notions of value creation. Traditional organizations reliant on particular formulae for success are inclined to approach innovation through the lens of incremental improvements to legacy processes, products and systems. Too narrow a focus on this objective leaves such organizations open to potentially fatal disruption arising from the creation of leap-ahead value by entirely different means – a state of affairs foretold by T.X. Hammes in his June 16, 2014 article “The Future of Warfare: Small, Many, Smart Vs. Few & Exquisite.”

For example, beginning in 2004 insurgents in Iraq successfully capitalized on the opportunity for technology-based disruption through the widespread use of improvised explosive devices (IED) targeting U.S. and coalition forces. Constructed from found items and repurposed consumer-grade electronics, IEDs are a cheap and deadly weapon that would ultimately account for over two-thirds of military deaths from hostile action in Iraq. The effectiveness of IEDs owes in large part to their low cost, lack of technological standardization and diverse delivery options – a combination of characteristics that has proven problematic to the conventional DoD acquisition cycle.

As the IED example demonstrates, rapid, technology-based disruption represents a potential challenge for the Pentagon. To the extent that technological innovation is a core competence of the modern U.S. military, such innovations are traditionally linked to substantial internal investments associated with the development of purpose-built weapon systems and enabling products. Throughout the Cold War, global R&D output was substantially concentrated within DoD, allowing the U.S. military to build and maintain a decisive technology advantage. Whereas the Soviet Union maintained a two-to-five times numerical superiority in manpower over the United States and NATO in virtually every category of conventional forces, the United States countered this asymmetry through R&D focusing on qualitative improvements to conventional and strategic weapon systems. This competition ultimately led the Soviet Union to collapse under the weight of its own military force structure.

During the Cold War, DoD’s access to healthy supplies of risk-taking capital contributed to it becoming a net exporter of technology with broad commercial applications. The Internet, wireless communications, semiconductors, and a host of other innovations on which the modern U.S. high-tech economy is built are derivatives of early defense investments. However, over the previous two decades, U.S. federal and defense spending has failed to keep pace with the explosion of commercial market-based R&D investment. Once the center of the global R&D universe, by some estimates DoD represented less than 5% of total international R&D in 2013, a relative percentage that is projected to further decline in future years.

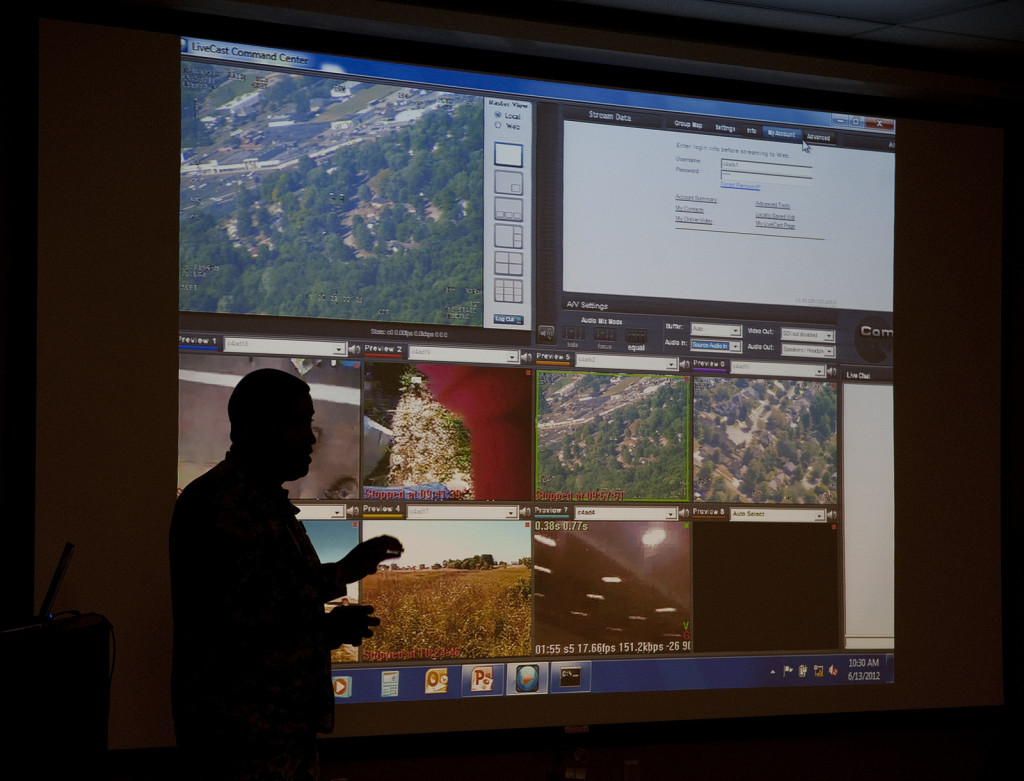

Today, with the accelerating migration of R&D investment to the commercial sector, the opportunities for technology-based disruption of U.S. defense equities are amplified. High-tech heavyweights like Google are actively pursuing the development of military-grade technologies such as unmanned aerial vehicles and satellite-based surveillance systems, foretelling a near future where commercial industry assumes outright technological superiority in areas once exclusively reserved for national defense. Within this context, DoD’s ability to successfully hedge against disruption is increasingly dependent on identifying and adapting innovations from the commercial marketplace.

Since 2001, the trends of rapid innovation, technology disruption and commercial R&D growth, alongside the imperatives of combat operations in Iraq and Afghanistan, led DoD to prototype a number of “rapid acquisition”initiatives designed to capitalize at least in part on commercially derived products. Military organizations such as the U.S. Army Technical Operations Support Activity, the U.S. Army Rapid Equipping Force, and the Joint IED Defeat Organization have pursued an agenda to speed up the flow of life-saving innovations to the front lines of conflict, rethinking how DoD sources, develops, procures and fields new capabilities with improvised threats in mind. But with large-scale combat operations in Iraq and Afghanistan drawing to a close, the DoD rapid-acquisition enterprise is in danger of becoming a casualty of sequestration-era budget pressures. A 2014 Army Science Board study entitled Creating an Innovation Culture in the Army, highlights DoD’s limited success preserving, much less scaling, the relationships that various rapid-acquisition organizations have built with the commercial marketplace. To the extent that the underlying forces shaping the contemporary technology landscape are still at work and increasingly evident in the global threat environment, such a failure represents a strategic vulnerability that Secretary of Defense Chuck Hagel underscored in his comments preceding the release of the fiscal year 2015 defense budget request. Hagel noted, “the proliferation and development of more advanced military technologies by other nations means we are entering an era where American dominance on the seas, in the skies, and in space can no longer be taken for granted.”

The explosion of global public and private R&D investment has led to the proliferation of increasingly sophisticated component, design, prototyping and manufacturing technologies, enabling a new generation of innovators and threats that learn in rapid, iterative cycles. In short, the steady state threat and technology environments around which the legacy defense acquisition system and the defense industrial base came into being in the Cold War have been replaced by an uncertain, rapidly evolving world subject to disruptions that cannot be predicted or planned for with a high level of certainty. It is within this innovation environment that DoD must now compete.

Technology Domain Awareness (TDA) aims to counter this strategic vulnerability. Still in its formative stages, the TDA initiative is being led by the DoD IACs to promote faster, more cost-effective defense capability development capitalizing on commercial market efficiencies, networked knowledge and lessons learned from past engagements. TDA provides a defense-wide platform for identifying, synthesizing and amplifying technology-based innovations and lessons learned in order to enhance scalability, adoption and impact while improving defense stakeholder awareness of “outside innovations”– technologies derived from, or underwritten by, the commercial (non-defense) R&D marketplace.

Even as many of the major defense firms are following the lead set by Boeing and Airbus and increasingly building for the commercial marketplace first as a hedge against flat or declining defense budgets, DoD must likewise develop improved capabilities to prospect, vet and transition commercially derived technologies to augment organic R&D efforts. To this end, TDA seeks to build an extended defense-focused innovation base that (1) informs the existing defense acquisition enterprise by broadly aligning innovative commercial and consumer-facing products with defense applications; and (2) complements the defense industrial base by creating a flexible, scalable industry platform, where businesses and institutions primarily focused on non-defense markets can easily “opt-in” to support the rapid, cost-effective development of new defense capabilities.

Paraphrasing Darwin, management sociologist Leon Megginson once said: “It’s not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.” In a threat environment subject to constant, rapid disruption the appropriate military-capability package for any given scenario is not only a question of degreebut also a question of kind. In the current innovation environment, the imperative for DoD is to augment a defense acquisition system that has proven so effective at equipping the U.S. military for industrial-scale warfare by improving its capacity for rapid adaptation at scale. This is the raison d’être of the defense innovation base.

Former Under Secretary of Defense for Acquisition, Technology and Logistics, Jacques Gansler has argued in reference to the defense acquisition system that “there is a need for a parallel track: first, find and implement ways to reduce the costs of national security itself, and second, find and implement ways to strengthen the U.S. economy through dual-use investments in security and economic growth.” The concept of a defense innovation base encompasses these goals, but even more fundamentally, it seeks to create an explicit, complementary system consisting of a more diverse, independent and unencumbered set of participants. These participants can include commercial firms, academic institutions and even private citizens capable of augmenting the dedicated defense industrial base in a way that yields both performance relative to the industrial-scale requirements of major military conflicts and resilience in the face of disruption.

The key to innovation is discovery. In a global threat environment where (1) technology-based disruption is increasingly prevalent, (2) innovation has assumed a decisive role and (3) the commercial marketplace is driving advanced technology development, the ability of DoD to maintain a decisive technological edge is dependent on its capacity for discovery as underwritten by a vital and engaged defense innovation base. Within this context, TDA seeks to federate the commercial R&D marketplace as a full partner in the nation’s defense.

Adam Jay Harrison is Director of the Center for Smart Defense at West Virginia University. He is former Director of the Department of Defense Technical Operations Support Activity and founder of Mav6, an Inc. 500 aerospace and defense technology company.

Jawad Rachami is the Founder and CEO of Cylitix LLC, specializing in the application of human-centered design and collaborative innovation models to technology development programs. Jawad has over 16 years of experience in the execution and management of federal programs. He is a published author and an FAA-certified commercial pilot.

Christopher Zember is Director of the Department of Defense’s Information Analysis Centers, which annually conducts over $1.5 billion in technology-centered research and analysis. His prior positions include work in national security policy, Defense planning, and intelligence analysis, with posts both inside and outside government, in the U.S. and abroad.