DTC FAST Services

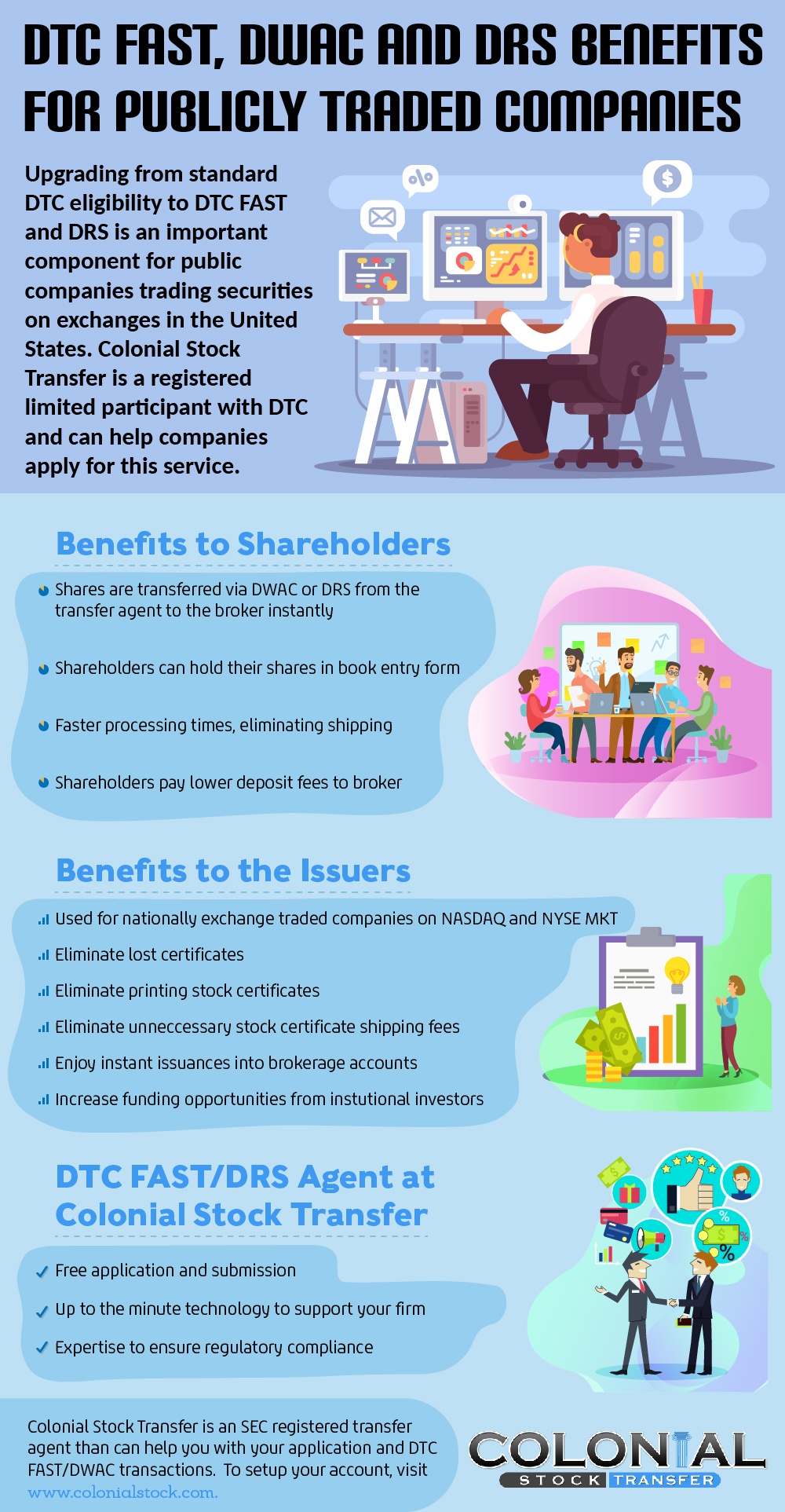

Colonial Stock Transfer Company is an approved DTC FAST/DRS ("Fast Automated Securities Transfer/Direct Registration System") agent participant. Through the DTC FAST program, shareholders are able to hold their normally certificated shares in book-entry electronic form with the transfer agent directly. These shares can be transferred via DWAC from the transfer agent to the broker and vice versa without having to go through DTC. This speeds up processing times and allows shareholders the option to be issued physical or book-entry certificates.

Here are some of the benefits of becoming an electronic DTC FAST or DWAC issuer:

- Eliminate lost certificates and associated replacement fees.

- Eliminate lengthy broker physical certificate deposits and associated processing fees.

- Eliminate printing of stock certificates.

- Enjoy instant transfer of shares to brokers by eliminating courier shipments and associated fees.

- Increase funding opportunities from institutional investors, lenders, and investment bankers.

How does it work? Two ways.

- Shareholders can deposit/withdraw their shares directly into/from the DRS system held by DTC. Learn more about DRS

- Shareholders may send in their physical certificate to be converted into book-entry and sent to a broker via DWAC (Deposit/Withdrawal At Custodian). Learn more about DWAC

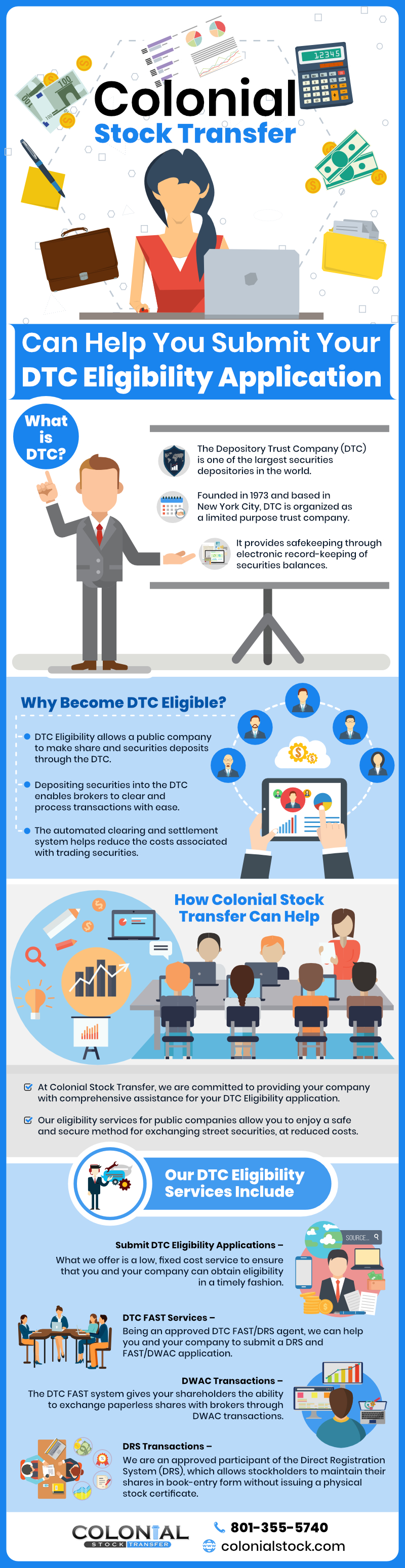

DTC FAST/DRS Applications

Each issuer must be approved and accepted by DTC to become a DTC FAST/DRS eligible issuer. Because DTC is strictly regulated by the SEC, US Treasury and Federal Reserve, it must comply with multiple regulations in approving issuers. With this obligation, DTC has the right to not provide explanation of why an issuer is rejected. Here are some things that issuers can do to prepare for acceptance:

- If rejected, when you apply again be sure that it is 2-3 months after the rejection.

- Be fully reporting without missing or being late on any reports.

- Have few to no corporate actions (stock splits and name changes) and officer changes within the last 3-5 years.

- Be sure the company and officers are not involved in lawsuits or other fraudulent activities, such as pump and dump schemes.

- Avoid Reg 504D issuances or other unregistered resales.

- Clean up any Pink Sheet "Halt" or "Yield" statuses.

- Grow your company. The company may be too small or the financials are not large enough.

Please note that this should not be used as "counsel" or "guidance". Please consult your legal counsel for questions.