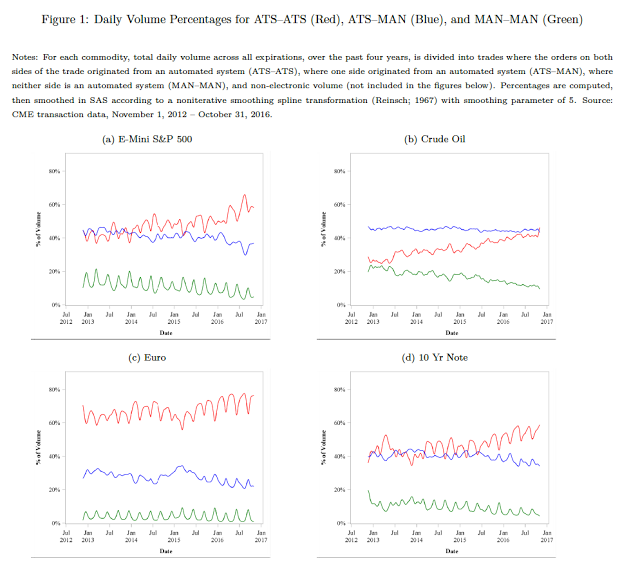

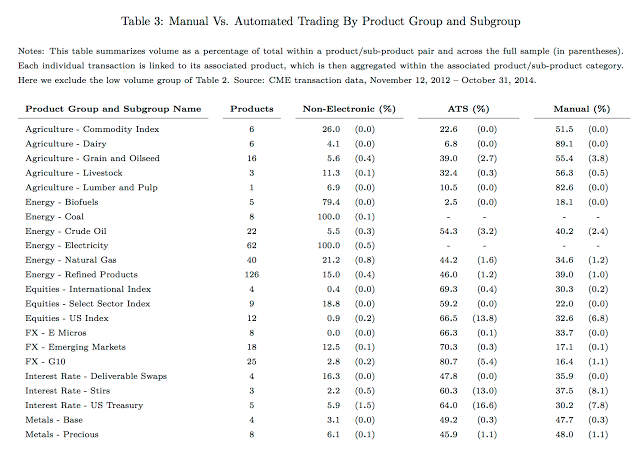

Automated execution is taking over futures markets. Actually, the battle is over. Voice (non-electronic) and manual execution are reserved for illiquid products, old school firms, smaller traders, those who may be undertaking spreads, complex legged or option strategies, roll strategies, and some block trade. However, the use of electronic trading can vary by market and sector. Technically, we are referring to manual (MAN) versus automated (ATS) trade execution where automated is generated and/or routed without human intervention. Non-electronic would be a separate category. By far, automated to automated trades dominate most markets even in many commodities. The high frequency automated traders are the new market scalpers. Financials have a higher percentage of automated trading over commodity markets.

From the latest CFTC research, (see Automated Trading in Futures Markets by Haynes and Roberts), we have a graphical analysis of the ascent of automated trading across many markets. Some markets have seen slower growth but the direction is all the same.

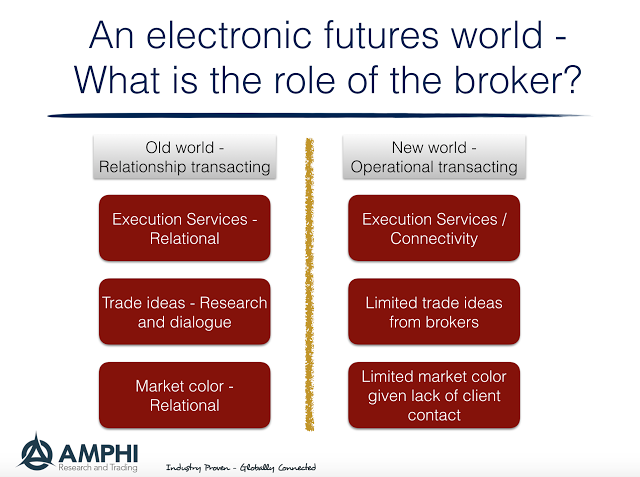

What does this mean for the brokerage world? The overall theme is that relationship brokerage has come to an end. We define the old world of relationship brokerage as an environment where brokers provided access to execution services, generated trade ideas and execution strategies for working an order, and market color from what they were seeing in the market. The new world provides easy market execution services and connectivity at low prices, but there is limited interaction between users and brokers concerning trade ideas and market color. The fee and service of a broker relationship with a client is broken. For many who did not need the relationship services, this is a good thing. You get anonymous wholesale execution and low prices, but for those that need support for market analysis, the service is not present.

I make no value judgment when I say the world has changed. Pricing for brokerage is sharper, but information flows may be worse. Information flow and color has always been a two-edged sword. The color you receive on the behavior of others comes at the price that your information may be seeping to competitors. Nevertheless, market anonymity causes fragmentation, uncertainty, and potential volatility at extremes. There is more unknown about competitor actions. In the new world, there is still a need for information flow, color, research, and execution services. It will just have to come through some other conduit.