The Indian market was on a dream run in 2017. The rally somewhat fizzled out in the first half of 2018, but both the Sensex and Nifty have managed to recoup losses and are trading in the green.

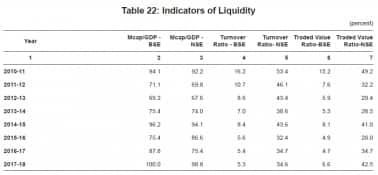

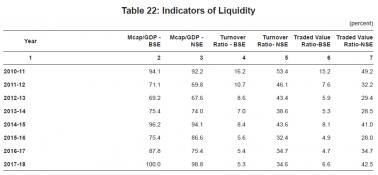

The fierce move on D-Street, which pushed the index up about 29 percent, also lifted the market capitalisation-to-GDP to an 8-year high, according to data from the Securities & Exchange Bank of India’s Handbook of Statistics 2017. The last time the mcap-to-GDP ratio was trading near record peaks was 2014-15 at 96.2, followed by 2010-11 when it touched 94.1.

India’s mcap-to-GDP ratio (BSE) touched the 100-mark in December last year. This valuation indicator suggests the market is entering the overvalued zone. Any value above 100 could be described as overvalued.

Thanks to market guru Warren Buffett, who described this ratio as the “best single measure of where valuations stand at any given moment” in a December 2001 article for Fortune magazine. “Mcap-to-GDP ratio is used as one of the metrics to determine whether stock markets are undervalued or overvalued. Since mcap is supposed to represent the earnings potential of companies and GDP represents production in the economy, mcap in excess of GDP is typically considered (over 100%) overvalued and vice versa,” Vidya Bala, Head of Mutual Fund Research at FundsIndia, said.

However, there is a catch. “First, this ratio was popularised by Warren Buffet in the US where equity is the preferred mode of savings and therefore economic growth is reflected in terms of more savings being channelised into the market. This is not so in the case in India,” Bala said.

Only in the past couple of years have we seen ‘financialisation’ of savings and the same is not fully represented in the stock market. Hence, this cannot be the only metric to assess valuations in India.

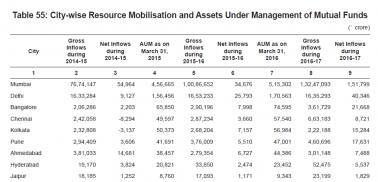

Mumbai, Delhi tops the list in MF flows

One thing is certain funds are moving from savings accounts or lockers to mutual funds and this is getting reflected in higher fund inflows, which rose from Rs 110 lakh crore in 2014-15 to Rs 176 lakh crore in 2016-17. Net fund inflows in 2016-17 from the Mumbai region stood at Rs 1.5 lakh crore, Rs 40,000 crore from Delhi and Rs 21,668 from Bengaluru.

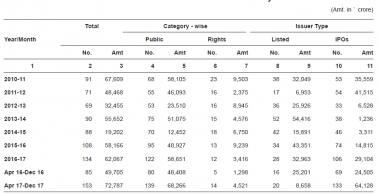

Resource mobilised from the primary market

Amount raised from the primary market via initial public offerings rose to Rs 64,128 crore in April-December last year, much higher than the Rs 41,515 crore raised in 2011-12 and Rs 35,559 crore recorded in 2010-11. The number of IPOs listed stood at 133, up from 106 in 2016-17 and 74 in 2015-16.

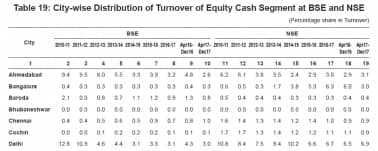

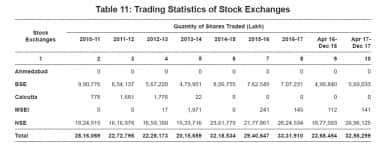

Mumbai and Ahmedabad top turnover in equity cash segment

In the last two years, the number of demat accounts have more than doubled, but Mumbai and Delhi led the list of cities driving turnover on D-Street. Mumbai now accounts for more than half of the equity cash segment on the BSE at 61.8 percent during April-December 2017, followed by Delhi which accounts for 3 percent and others at 23.8 percent.

Traded value ratio

The turnover-to-GDP ratio of the National Stock Exchange stood at 42.5 percent, much lower than the 49.2 percent seen in 2010-11. For the BSE, it has fallen from 15.2 percent in 2010-11 to 6.6 percent in 2017-18. A fall in the ratio signifies that the traded turnover is not rising at par with the growth in the economy.

Traded volume

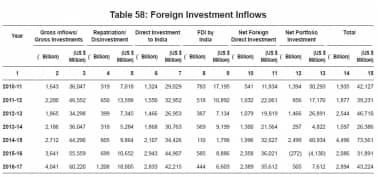

Foreign investment inflows

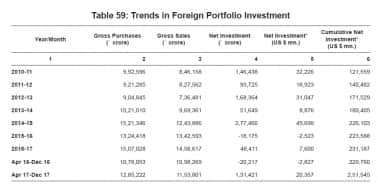

Trend in foreign portfolio investment

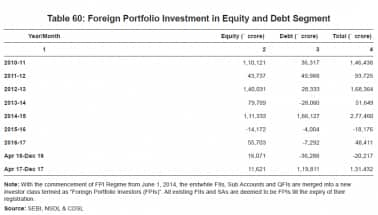

Foreign portfolio investments in equity and debt segment

Foreign portfolio investments in equity and debt segment

(Source: The above data is compiled from SEBI's Handbook of Statistics 2017)

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!