- India

- International

Reliance Lyf is fifth largest smartphone brand in India: Counterpoint data

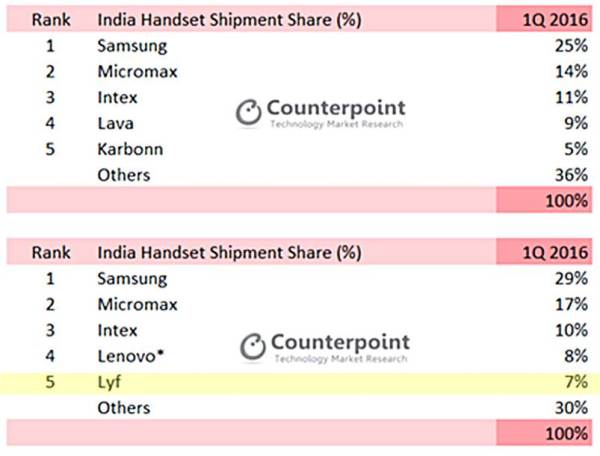

Samsung was again on top in both smartphones and overall handsets powered by the good performance of its flagship Galaxy S7/S7 Edge and popular J series.

Reliance Lyf has launched a couple of models in India.

Reliance Lyf has launched a couple of models in India.

It might surprise many, but Lyf, the smartphone brand from Reliance, has emerged as the fifth largest smartphone vendor in India as per the Q1 2016 figures of research firm Counterpoint’s Market Monitor service.

This is not such a big surprise when you consider that Reliance is running a test service of its yet-to-be-launched RJio 4G LTE services for employees, most of whom would be using their own brands of phones. With a 7 per cent market share, Lyf also became the second largest LTE vendor in India ahead of Micromax and Lenovo.

“In first quarter of its inception, LYF instantly climbed to become one of the top five smartphone brands in India in terms of shipment volumes. Jio with its massive LTE network and scale could be the key player to watch out for as it has already become the second largest LTE phone supplier during the quarter,” said Tarun Pathak, Senior Analyst at Counterpoint.

The firm said these strong shipments were more of “channel filling” and the actual sell-through will happen in Q2 2016 as the operator starts full-fledged marketing and promotional activity.

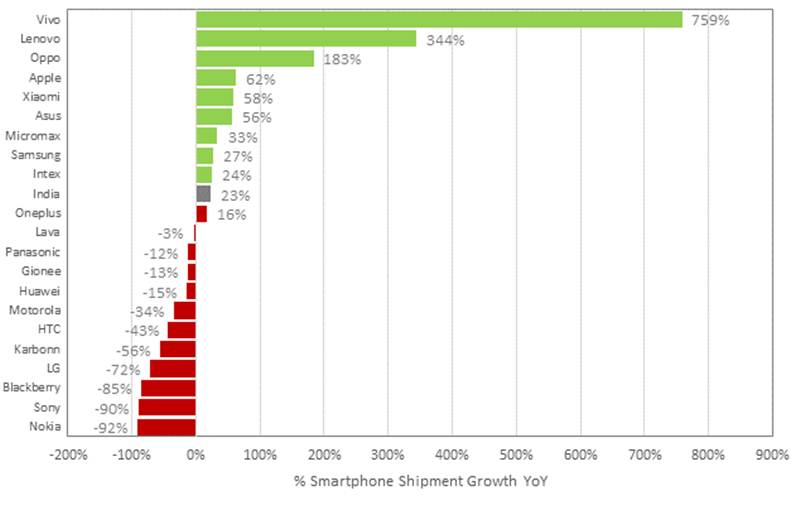

Samsung was again on top in both smartphones and overall handsets powered by the good performance of its flagship Galaxy S7/S7 Edge and popular J series. Apple recorded 62% annual growth in the first quarter despite of negative growth results globally for iPhones.

However, the big success story was the Chinese brands which recorded significant year-over-year growth numbers. Vivo was up +759 per cent, OPPO +183 per cent and Xiaomi +35 per cent as the Chinese brands captured 21 per cent share of total smartphone shipments in Q1 2016, says the report.

“The Indian smartphone market demand was healthy, as we saw newer brands enter with attractive offerings and aggressive pricing throughout the quarter. The demand for LTE smartphones remained strong as two out of three smartphone shipped was LTE capable. With 4G LTE capability, 5-inch and above screen size is becoming important for Indian consumers as more than 60 per cent of the smartphones shipped were phablets,” Pathak added.

Peter Richardson, Research Director at Counterpoint Research said India, which surpassed the US to become the second largest smartphone market in terms of users, has continued to register strong demand for smartphone. “There is a massive opportunity for every player in the mobile value chain when the second largest market by volume is still under penetrated and growing, while the rest of the world smartphone demand has waned. India is the next China,” he said.

Richardson estimates that more than a billion smartphones will be sold in India over the next five years. “This will drive the number of smartphone users from quarter of a billion to more than half a billion in the same time period, which will still be just 55 per cent of the total population.”

Meanwhile, Microsoft further lost its market share with shipments now accounting for less than half a per cent in Q1 2016.

Apr 26: Latest News

- 01

- 02

- 03

- 04

- 05