What's coming up in US trading

Initial jobless claims were a touch better than expected to start the US trading day but the continued twists and turns in the Greek drama as well as some economic data will be the highlights.

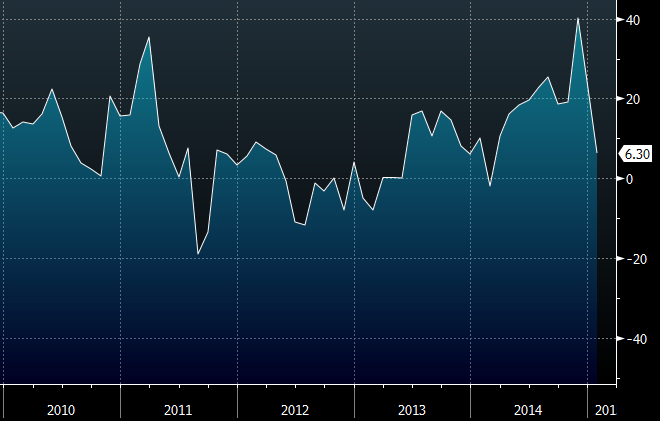

The main event is at 1500 GMT (10 am ET) when the Philly Fed is released. The consensus estimate is for a slight improvement to 9.0 from 6.3. It's the first manufacturing report for February and often sets the tone but even in recent months where factories have showed weakness, the US dollar has generally shrugged it off.

Over the past two months, the series has been volatile.

Traders will be juggling Philly Fed headlines with Eurozone consumer confidence and headlines from the Bundesbank's Dombret due at the same time along with the lowly Leading Index.

The focus then shifts to central banks with the ECB's Weidmann due at 1630 GMT and BOC's Cote at 1715 GMT.

Bond yields were a driver of USD/JPY yesterday and that's likely to be the case again with a 30-year Treasury auction at 1800 GMT. Benchmark 30s are yielding 2.705%.

More on the economic calendar.