When it comes to online budgeting and expense tracking, there are plenty of solutions, but two of the biggest names in the business are Mint and You Need a Budget (YNAB). Which is better? How are they different? Is YNAB worth paying for? Which should you choose for your budgeting?

We'll take a walk through both of them to find out.

One Thing to Note

Before we get started, there's one important thing you need to understand: Mint is a budgeting and expense tracking app, and You Need a Budget (YNAB) does those things too, but it's also a budgeting system. To best use the YNAB online app, you'll want to use the system that it's built for. You can use for it for any kind of budgeting that you want, but the app was designed to use the YNAB philosophy, and that's what it works best for.

Fully understanding that system takes a while, but you can read about the three main rules on the YNAB website. I'll try to give you an idea of how it works throughout this article, too. For now, though, we'll just start comparing features of the two apps.

Dashboards

You can start to get an idea of how these two apps are different just by looking at the dashboards you see after signing in.

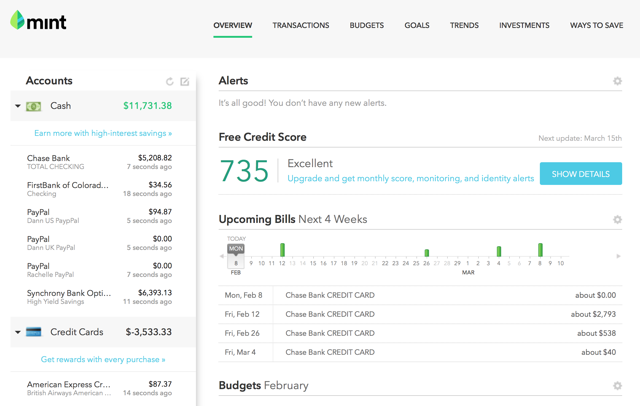

Here's what you see when you log into Mint:

Down the left, you'll find a list of your accounts, including checking, saving, credit cards, loans, and investment accounts. If you scroll down to the bottom, you'll also see your net worth and a comparison between your cash and credit card debt. The larger pane of the dashboard shows you your credit score, upcoming bills, your current progress on your monthly budgets, and how you're doing on your financial goals (like saving for retirement or a down payment on a car). You'll also see some ads for financial services from Mint's partners.

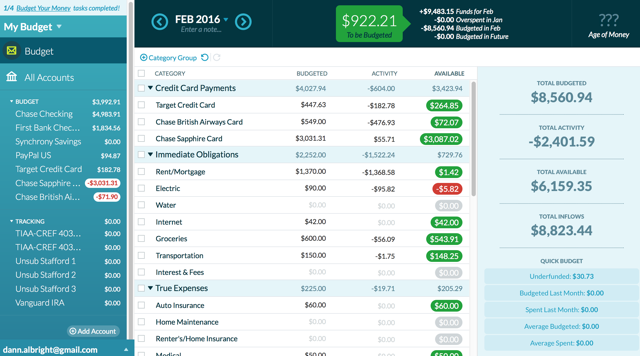

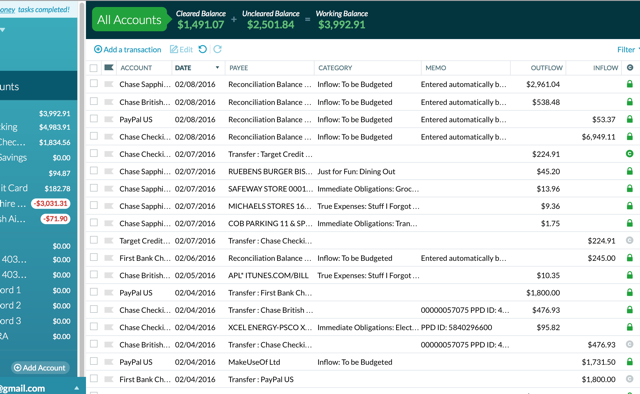

The YNAB dashboard, on the other hand, gets you directly to your budget and includes the information you need to use their three-rule system:

Your accounts with balances are displayed on the left, and the rest of the screen is taken up with your budget. You can see the amount you've budgeted, the amount you've spent, money you have available, the amount you still need to budget, and how you're doing on all of your monthly budgets. Compared to Mint, it gets you to the information that you want faster and it's less cluttered.

Winner: YNAB.

Importing Accounts

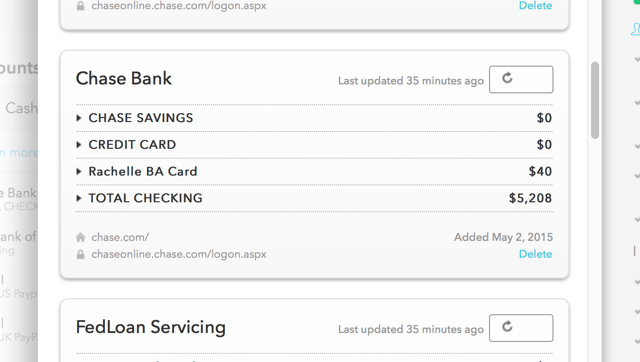

Getting Mint set up is as simple as selecting your bank and entering your credentials. Mint will go out to the bank website and import all of your accounts from that website.

Repeat for all of the different checking, savings, credit card, investment, and loan accounts that you have. You can then rename any of the accounts if it's easier to keep track of them (as you can see I did with "Rachelle BA Card" above).

While this is an easy process, Mint does have occasional connection problems with various accounts. For example, my Target card couldn't sync for about 6 weeks, and every once in a while I get notifications asking if my PayPal account has closed, because Mint can't find it. The Target card issue was irritating, but the other issues seem to resolve within a day or two.

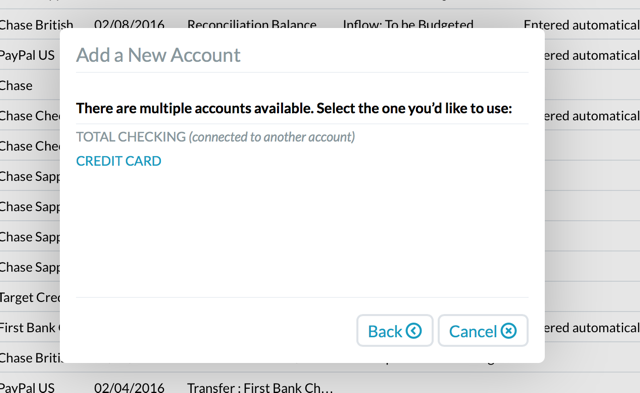

YNAB uses a similar method: search for your bank, enter your credentials, and it'll bring in the accounts. However, you can only import one account at a time, so if you have multiple accounts with the same bank, you'll need to enter your credentials multiple times to get them all in.

It takes about 24 hours for YNAB to pull in your transactions, but you'll have a total account balance available right after importing your account. I found it a little counterintuitive to get accounts reconciled to their correct amounts once the transactions were imported, but it should get easier after a month or so has gone by and things balance out.

Despite that, You Need a Budget seems to establish more stable, consistent connections to accounts.

Winner: tie.

Monitoring Transactions

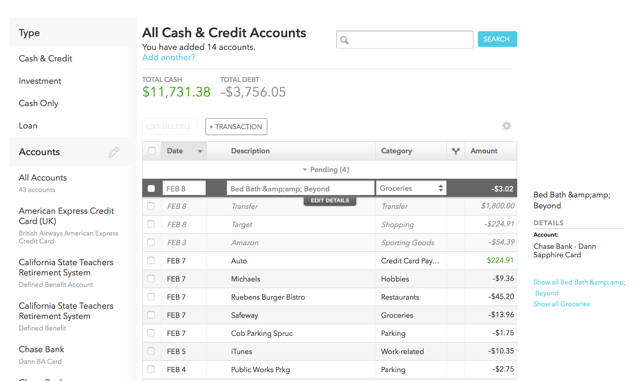

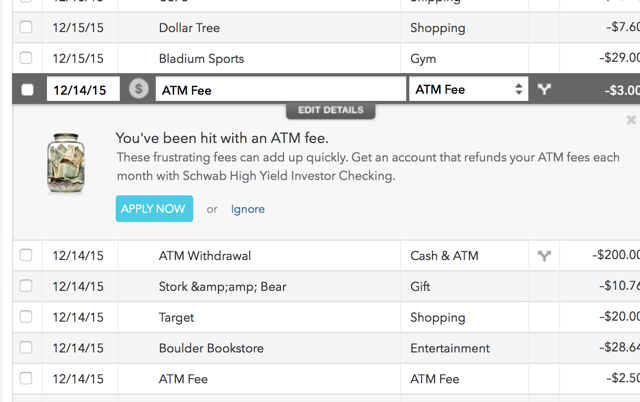

One of the main reasons people use an online budgeting and expense tracking app like Mint or YNAB is to see all of their transactions in a single place. Both apps make it easy. Here's what Mint's Transactions page looks like:

You see a register-like list of all your transactions with dates, merchants, categories, and amounts. When you click on a transaction, you get more details, like the exact name of the merchant on your bank statement and the account that it registered on.

To see the transactions from just one account, you click on an account in the left sidebar. You can also easily search for a transaction, view only specific categories or tags, and reorder the list. Adding tags to transactions lets you track cross-category spending, too, which is really nice, especially if you're using something like the 50/30/20 system of budgeting. (Adding tags and other useful tips are covered in 7 Advanced Tips and Tricks to Make You a Mint Expert.)

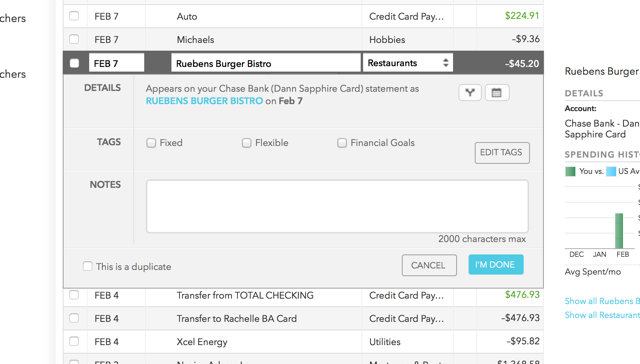

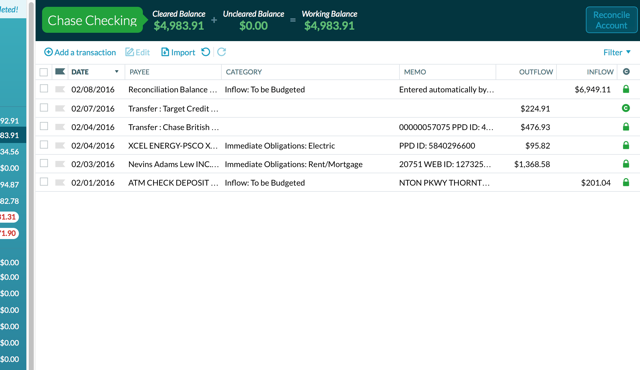

YNAB's transactions list shows most of the same information:

The account that the transaction took place from is more prominent, and you can add and view memos to each transaction if you need to. The added number of fields makes each field a little harder to read, but you don't need to click around as much to get the details. There's no search function, but you can click an account to see only the transactions from that account or filter to a specific date range.

The account-specific transaction list is similar, though it includes the Reconcile Account button, which lets you change the amount displayed for an account.

Winner: Mint (the search function is extremely helpful).

Budgeting

These are budgeting apps, so this is a really important category. It's difficult to compare, because the ways in which both apps help you budget are very different, and work on different principles. But we'll take a look anyway.

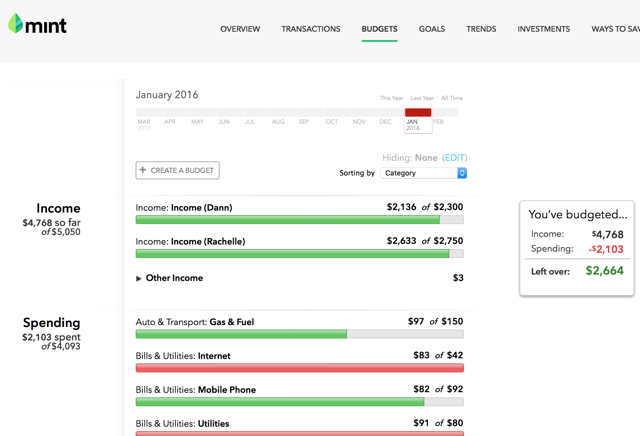

Here's Mint's Budgets page:

To set a budget, just enter the amount that you want to set aside for spending in a month, and the graphs will adjust to track your progress throughout the month (you'll need to make sure that categories are tagged correctly in the transactions list for this to work).

Budgets can be set to roll over, so that the balance from the previous month is added or subtracted from the next month's budget. Clicking on the name of a budget brings you to all of the transactions in that category.

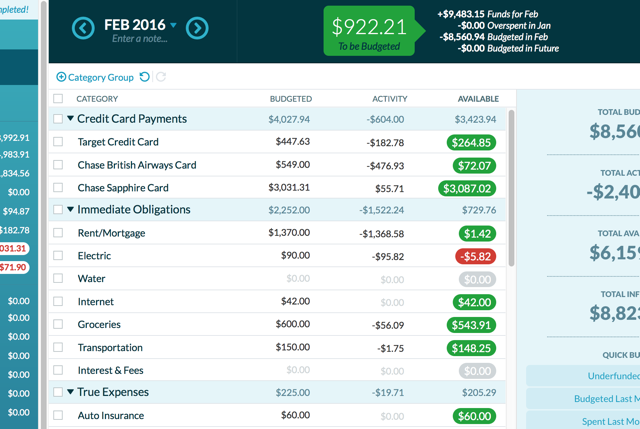

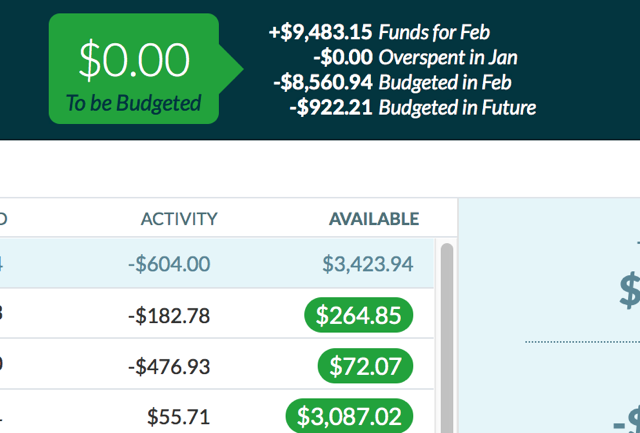

YNAB is fundamentally different. It's built to be more flexible, and it's easy to change the amount in any specific budget from month to month to accommodate changes in your priorities and situation.

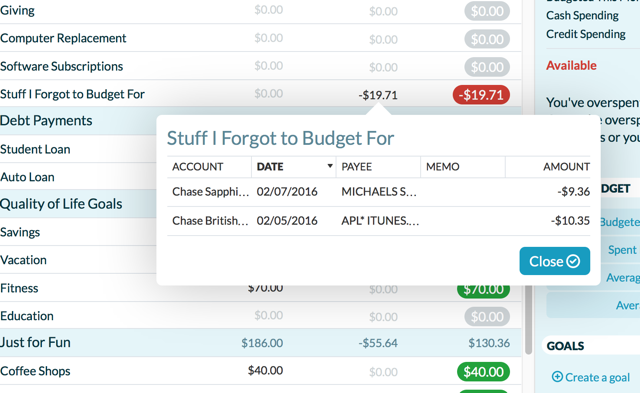

This is where you need to understand a bit about the YNAB system. The first rule of YNAB is that every dollar you have needs a purpose. It can go into a fixed budget, like "Rent/Mortgage," a more flexible one like "Groceries," or something totally different like "Stuff I Forgot to Budget For." You're also encouraged to budget for unexpected things, like medical expenses and home maintenance.

To set a budget, you just type the amount into the Budget column. The next month, you can budget the same amount with a single click, or you can set the budget to the amount you paid, the amount you underfunded the budget last month, or your average spending. Whenever you budget an amount, it's subtracted from the "To Be Budgeted" amount at the top of the screen, which represents all of the money you have, minus what you've given a purpose (assigned to a category).

This is a bit weird at first, as when you import your accounts, you'll need to assign all of the money from your savings accounts, which threw me off for a moment. Once you get used to the YNAB system, however, and use the app for a month or two to get everything reconciled, it starts to make a lot more sense.

When you click on the number under "Activity" for any budget, you'll get a little popup that shows you the transactions that contributed to it. This is a really slick way to display this information without leaving the page.

Winner: tie (depends on the budgeting system you prefer to use).

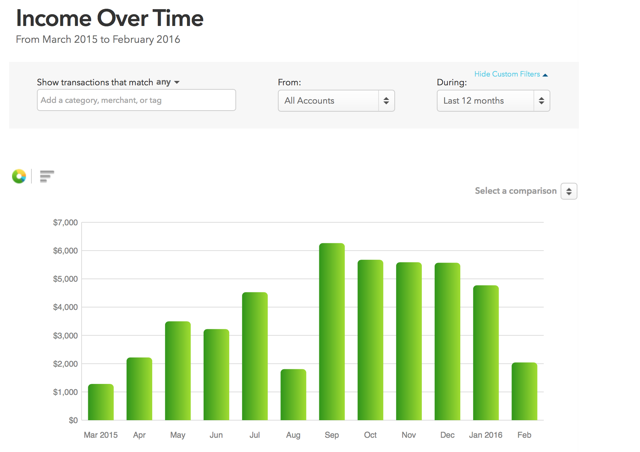

Trend Tracking & Visualization

It's almost unfair to include this category in the comparison, as YNAB doesn't have any equivalent of the capabilities that Mint has in this area.

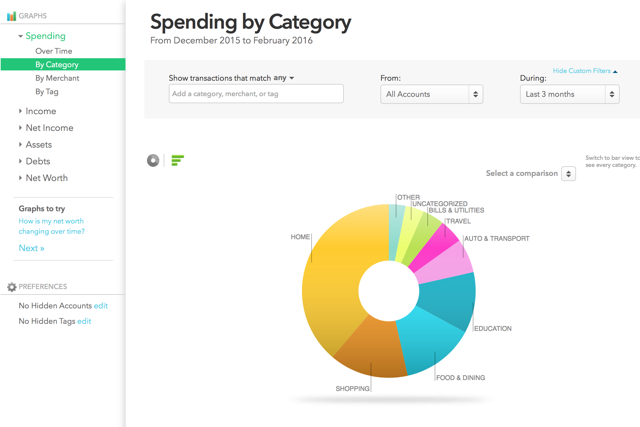

The Trends page in Mint gives you a wide variety of options for looking at patterns in your financial data, like this pie graph of spending by category over three months:

You can look at your spending, your income, your net worth, and other types of information over time, by category, by tag, and in other formats. It doesn't necessarily make Mint a more useful budgeting tool than YNAB, but some people like to be able to see this sort of information visually, and Mint is much better at this than YNAB.

Winner: Mint.

Price

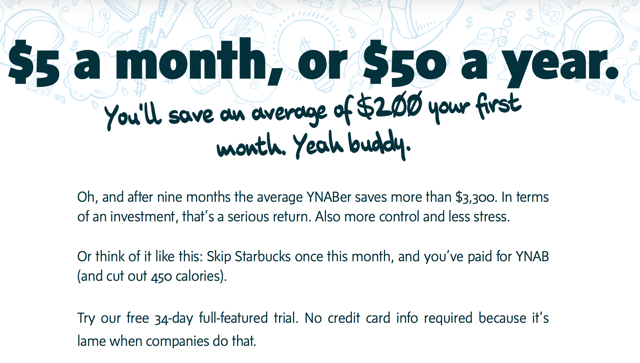

Mint is free. YNAB is currently in the process of going to a subscription model that will run you $5 per month or $50 for a year after a free 34-day trial. It's not a huge expense, but it feels like a lot when the alternative is free. Then again, you'll have to deal with some ads on Mint; you'll get a lot of recommendations for accounts and credit cards that Mint says will save you money. And that can be annoying sometimes.

Winner: tie (depends on whether you prefer a subscription fee or ads).

Should You Use Mint or YNAB?

Based on Mint's slight advantage in the categories listed above, I recommend Mint for the majority of people. It makes more intuitive sense, it's a bit more automated, and can show you more information. However, there are important cases in which you should use You Need a Budget.

If you think you need to be more hands-on with your budget to make sure it's effective, YNAB is good. You need to budget your money every month, and you can make changes depending on your financial situation, which makes it good for people whose spending or income varies from month to month.

Many people think that using a simpler solution like an Excel spreadsheet is a good idea because it makes you engage more actively with your budget, and YNAB's more hands-on approach could do the same.

Also, You Need a Budget's "job for every dollar" budgeting system is a unique one, and it works best with the YNAB app. There are a lot of people who believe very strongly in the YNAB system, and they say that if you stick with it, it can save you a lot of money -- their website states that first-month savings average $200 and nine-month savings average over $3,000, which is a pretty big deal.

Mint requires a bit more analysis of your current spending to get a solid budget for the future, and you don't get the same level of coaching as you do with YNAB (they have a lot of resources and even online classes to help you). But you'll also get a bit more functionality for free.

To see how these compare to other choices, check out the best budgeting apps to sort out your finances.