Fed thought US economy could handle rate rise

- Published

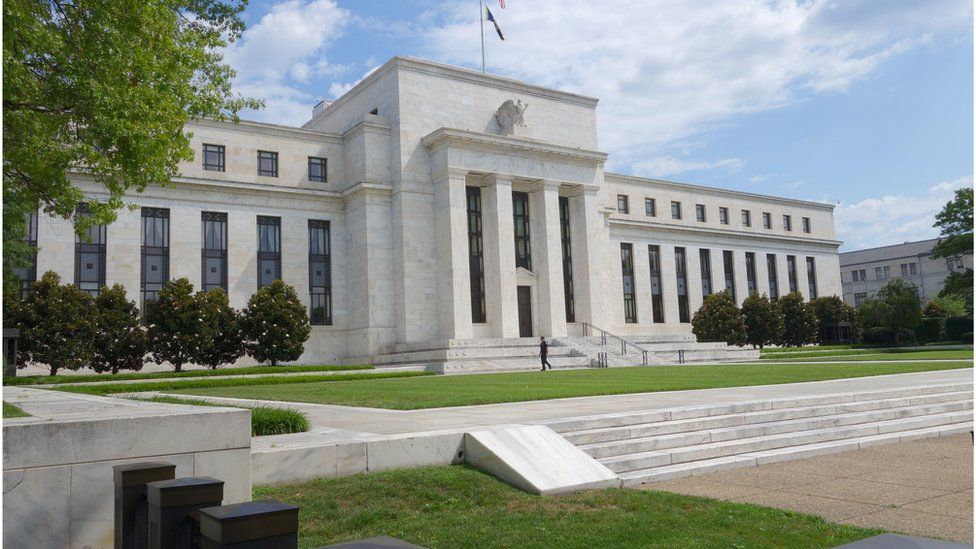

Federal Reserve minutes revealed it believed that the US economy could have coped with an interest rate rise.

The minutes from the September meeting showed members felt the problems in the global economy had not "materially altered" the outlook for the US.

However, the members of the Federal Open Markets Committee decided it was "prudent to wait" for more information before raising rates from near zero.

Some feared that a premature rate hike could harm the Fed's credibility.

Policymakers wanted confirmation the US economy had not weakened and that inflation would gradually return toward the Fed's 2% annual target.

Sal Guatieri, senior economist at BMO Capital Markets, said: "Simply put, the Fed still doesn't have enough confidence that the economy will remain strong enough to return inflation to the target to begin the tightening process."

The S&P 500 and the Dow Jones Industrial Average both rose 0.5% following the release of the minutes, while yields on US government debt edged lower.

The minutes showed that most policymakers still thought it would be appropriate to raise rates by the end of the year.

December rise?

However, many investors think there is almost no chance of a rate rise at the Fed's next meeting on 27-28 October and only a small chance of an increase at its December meeting.

"I believe the jobs report makes an October rate hike out of the question, but if we have some strong employment reports before the December meeting, then a case could still be made from a December rate increase," said Sung Won Sohn, an economics professor at California State University.

Postponing the rate rise may make it harder for regulators to act before 2015 is out.

Revised employment data from August and September showed that private sector hiring was lower than anticipated.

Wage growth has also stagnated, raising concerns about the Fed's ability to maintain its target inflation rate.

An increase from near-zero has been anticipated for months, but slow growth in the first quarter deterred the Fed from making a move in June.

Market expectations were high over the summer that the increase would come in September, but intense volatility and a slowdown in China again prompted policymakers to hold fire.

- Published17 September 2015

- Published17 September 2015