Art, royalties and other treasures of unclaimed estates

- Published

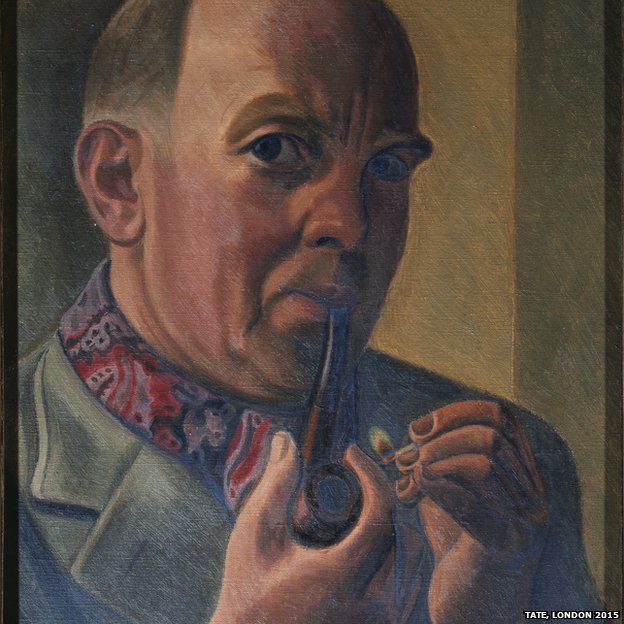

The late William Roberts was described as a man of sturdy independence, a prolific artist who interpreted British families' working lives and leisure pursuits in paint and on paper.

Much of this work sits in storage in the Tate, in legal limbo, owing to one simple omission.

William's son, John, was found dead at his home in 1995. In the house was a letter from his lawyer encouraging him to make a will. He never did.

With no known blood relatives, John's estate - including hundreds of works by his father - is one of thousands which have landed on the desks of the Bona Vacantia division, part of the Government Legal Department.

It seems likely that no heirs will be found. Under the rules, the art should eventually be sold for the best price and the proceeds handed to the Treasury. The chancellor, George Osborne, might recognise the work - his parents once had a Roberts painting hanging over their fireplace.

Yet, the benefit for taxpayers is likely to be cultural, rather than financial, as the art is on loan to the Tate.

As for more than 15,000 other estates on the Bona Vacantia division's unclaimed estate list, their fate depends on whether anyone can prove they have a genuine inheritance claim.

Tax and art

Step into the 1910 room at Tate Britain in London, and the eighth work of art on the right is The Cinema by William Roberts.

It is the only work by Roberts that is on display in the free galleries of the Tate, but others are on show in galleries around the UK.

The story of his life's work is more accurately told in the unseen Tate collection.

A founder of the Vorticist art movement, he died in 1980 and his wife Sarah died in 1992. Her death led to an inheritance tax bill which was settled when 117 works were eventually allocated to the Tate collection in lieu of the tax.

When their only child John died, friends organised for about 550 of William's works, which had been in John's possession, to be stored at the Tate.

"John and his mother had hoped to set up a house museum [including these works], but they never managed to get the funding," said Michael Mitzman, a consultant at legal firm Mishcon de Reya.

"I nagged him [John] to write a will."

But he did not and 430 of these works form part of the estate which is being overseen by Bona Vacantia.

It will be held for another 10 years - some 30 years after John's death - to give any surviving members of the family the chance to make an inheritance claim.

In this case it is highly unlikely. Mr Mitzman could find no eligible relatives. The BBC's Heir Hunters programme drew a blank when searching for direct descendants.

Enter the William Roberts Society which foresaw the threat of these works being sold and the money ending up in the Treasury coffers.

It argued that the artwork that the Roberts family owned should be kept together for the benefit of the public and students. The government eventually agreed. One minister said the intention was to give this work to the Tate should no relatives come forward.

Elsewhere on the BBC

In the vaults

Artwork by an English cubist is not the only unusual asset on the books of estates being dealt with by the Bona Vacantia division.

One actor's estate includes royalties still being paid for re-runs of The Benny Hill Show and Hancock's Half Hour. The office was also asked, but declined, to get involved in one case from 1896, with an estate including shillings and a horse.

About 2,000 new unclaimed estates are referred to the division each year.

"The average estate is worth less than £4,000. These are not life-changing sums of money. But they are almost like a little lottery win [for eligible relatives]," says Melanie Hooper, head of the estates group in the Bona Vacantia division.

"Whether the size of the estate is £500 or £500,000 does not matter to us. It is the entitlement, not the amount, that matters."

The little-known Bona Vacantia division has a staff of 50, of whom 18 deal with estates.

What is Bona Vacantia?

Bona Vacantia means vacant goods and is the name given to ownerless property, which by law passes to the Crown.

The Treasury Solicitor acts for the Crown to administer the estates of people who die intestate (without a will) and without known kin (entitled blood relatives) and collect the assets of dissolved companies and other various ownerless goods in England and Wales.

Unclaimed estates are dealt with separately in two areas of England - the Duchy of Cornwall and the Duchy of Lancaster - by lawyers for Prince Charles and the Queen respectively.

In Scotland, unclaimed estates are dealt with by the Office of Queen's and Lord Treasurer's Remembrancer.

In Northern Ireland, the responsibility for dealing with them is that of the Crown Solicitor for Northern Ireland.

The division handled 4,332 estates in England and Wales in the year to the end of March 2015, accounts show. It collected income of £18.4m, and paid out £6.1m - most of which would have gone to relatives with claims on estates.

In an intriguing twist of law in England, cases in Cornwall and around the North West of England are administered by solicitors for Prince Charles and the Queen. Any funds that remain after an allowance for future claims and costs go to charity.

In the Duchy of Cornwall in 2014-15, some £215,000 was given to the Duke of Cornwall's Benevolent Fund which primarily supports environmental, conservation, wildlife and community projects.

Some £2.47m was given to the Duchy of Lancaster Jubilee Trust to fund charitable causes, particularly the maintenance of historic buildings on Duchy estates. This covers Lancashire, Merseyside, parts of Greater Manchester, parts of Cheshire and parts of Cumbria.

Making a claim

In the vast majority of cases, eligible descendants come forward to claim an estate, so how do they know they have an entitlement?

It used to be the case that estates were advertised in The Times and the local newspaper where the individual was born.

Now unclaimed estates in England and Wales are being added to an online list. This process is expected to be completed in September when it will include all unclaimed estates which have been recently referred, but not yet administered, and historic cases which have not yet been claimed by entitled relatives.

The list in Scotland includes the value of the unclaimed estates.

Relatives ranging from a husband, wife and civil partner to half uncles, aunts and cousins may have an entitlement claim when somebody dies without having made a will.

A touch of detective work by these individuals or solicitors can unearth their eligibility.

Others may receive a call out of the blue from a private genealogist, or heir hunter. This industry has grown from a dozen or so private firms to more than 100 now.

They tend to alert people that they might have a claim, and organise the paperwork involved before taking a cut of any successful payout.

The advantage for customers is that genealogists might have found a link to an estate of somebody whose name they do not recognise. It is their choice whether or not they want to use the private firm's services. They can look at the Bona Vacantia website for information before making a decision.

Various rules are involved in making a claim including:

- Paperwork. A family tree and identification are among the documents required to prove eligibility

- Partial entitlements. Some relatives are only entitled to a share of the estate

- Deadlines. Claimants have 30 years from the date their relative died to make a complete claim, including providing all the documentation required. Only successful claims made within 12 years will benefit from interest paid on the estate (which has accumulated daily at 10 basis points below the Bank of England's base rate)

In England and Wales, the value of an estate is only revealed to a successful claimant. It might only be £500. It might be much more.

Very occasionally, it might it include art worthy of hanging on the walls of the Tate.