ATTORNEY GENERAL OF THE STATE OF NEW YORK IN THE MATTER OF

WETHERLY CAPITAL GROUP, LLC Investigation AND DAV/WETHERLY FINANCIAL, L.P. No. 2009-172

■

ASSURANCE OF DISCONTINUANCE PURSUANT TO EXECUTIVE LAW: In March 2007, the Office of the Attorney General of the State of New York (the "Attorney General"), commenced an industry-wide investigation (the "Investigation"), into allegations of "pay-to-play" practices and undisclosed conflicts of interest at public pension funds, including the New York State Common Retirement Fund. This Assurance of Discontinuance ("Assurance") contains the findings of the Attorney General's Investigation and the relief agreed to by the Attorney General and Wetherly Capital Group and its wholly-owned subsidiary DAV/Wetherly Financial, L.P. (together "Wetherly").

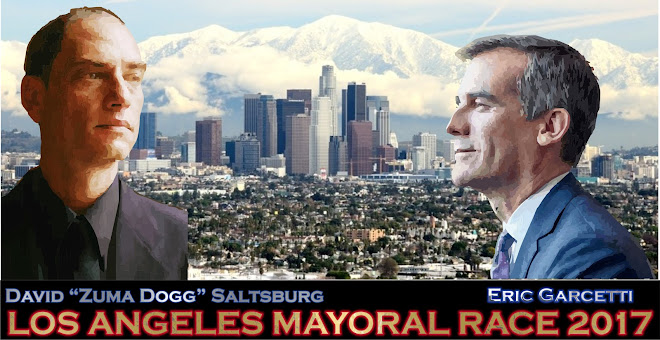

[BOTTOM LINE SUMMARY: Wetherly Capital (Dan Weinstein & his partner in crime Vicky Schiff) are not even allowed to THINK about pension money anywhere in the U.S., let alone consult, advise or anything else. SO LOOKS LIKE THE STORY ZUMA DOGG BROKE TO THE WORLD ONLY LAST MAY 2009 HAS ENDED WITH A "DING DONG THE WITCH IS DEAD" SCENARIO. Wonder how much ZD played in all of this, since he hooked up with Gary from Del Mar, CA who BLEW IT WIDE OPEN FOR ZUMA DOGG as a former associate and consultant to Wetherly. NICE!!! HOOOOOOOOODY HOOOOOOOOO! HERE'S THE REPORT ON HOW IT ALL WENT DOWN! Call Martin Scorcese to produce the film.]

WHEREAS, the Attorney General finds that trillions of dollars in public pension funds in the United States are held in trust for millions of retirees and their families and these funds must be protected from manipulation for personal or political gain; WHEREAS, the Attorney General inds that public pension fund assets must be invested solely in the best interests of the beneiciaies of the public pension fund;

WHEREAS, the Attorney General finds that the New York State Common

Retirement Fund in particular is the largest asset of the State and, having been valued at $150 billion at the time of the events described in this Assurance, was larger than the

entire State budget this year;

WHEREAS, the Attorney General finds that public pension funds are a highly desirable source of investment for private equity firms and hedge funds;

WHEREAS, the Attorney General finds that private equity firms and hedge funds frequently use placement agents, inders, lobbyists, and other intermediaries (herein, "placement agents") to obtain investments from public pension funds;

WHEREAS, the Attorney General inds that these placement agents are frequently politically-connected individuals selling access to public money;

WHEREAS, the Attorney General inds that the use of placement agents to obtain public pension fund investments is a practice fraught with peril and prone to manipulation and abuse;

WHEREAS, the Attorney General finds that the legislature has designated the New York State Comptroller, a statewide elected oficial, as the sole trustee of the Common Retirement Fund, vesting the Comptroller with tremendous powers over the Common Retirement Fund, including the ability to approve investments and contracts worth hundreds of millions of dollars;

WHEREAS, the Attorney General inds that persons and entities doing business before the State Comptroller's Ofice are frequently solicited for and in fact make political contributions to the Comptroller's campaign before, during, and ater they seek and obtain business from the State Comptroller's Ofice;

WHEREAS, the Attorney General finds that this practice of making campaign contributions while seeking and doing business before the Comptroller's Ofice creates at least the appearance of corrupt "pay to play" practices and thereby undermines public confidence in State government in general and in the Comptroller's Ofice in particular;

WHEREAS, the Attorney General inds that the system must be reformed to eliminate the use of intermediaries selling access to public pension funds, and to eliminate the practice of making campaign contributions to publicly-elected trustees of public pension funds while seeking and doing business before those public pension funds;

WHEREAS, the Attorney General is the legal adviser of the Common Retirement Fund under New York's Retirement and Social Security Law §14; WHEREAS, Wetherly and its principals, Daniel Weinstein and Vicky Schiff (together, the "Principals"), acknowledge the problems with "pay-to-play" practices and conflicts of interest inherent in the use of placement agents and other third-party intermediaries to obtain public pension fund investments;

WHEREAS, Wetherly and its Principals recognize the need for reform, and endorse the Attorney General's Public Pension Reform Code of Conduct, which, among other things, bans the use of third-party placement agents in connection with public pension fund investments in the United States;

WHEREAS, Wetherly has fully cooperated with the Attorney General's investigation.

1. Wetherly Capital Group is a placement agent firm whose principal offices are located in Los Angeles, California. Wetherly Capital Group's wholly-owned subsidiary, DAV/Wetherly Financial, L.P. is a registered broker-dealer. Wetherly was founded in 1998.

2. The New York Office of the State Comptroller (the "OSC") administers the New York State Common Retirement Fund (the "CRF"). The CRF is the retirement system for New York State and many local government employees. Most recently valued at $122 billion, the CRF is by far the single largest monetary fund in State government and the third-largest public employee pension fund in the country. The New York State Comptroller is designated by the legislature as the sole trustee responsible for faithfully managing and investing the CRF for the exclusive beneit of over one million

current and former State employees and retirees.

3. The Comptroller is a statewide elected oficial and is the State's chief fiscal oficer. The Comptroller is the sole trustee of the CRF, but typically appoints a Chief Investment Oficer and other investment staff members who are vested with authority to make investment decisions. The Comptroller, the Chief Investment Officer and CRF investment staff members owe iduciary duties and other duties to the CRF and its members and beneiciaries.

4. The primary functions of the OSC are to perform audits of state government operations and to manage the CRF. The CRF invests in speciic types of assets as set forth by statute. The statute's basket provision allows a percentage of the CRF portfolio's investments to be held in assets not otherwise speciically delineated in the statute. From 2003 through 2006, the CRF made investments that fell into this "basket" through its Division of Alternative Investments. This division was primarily comprised of staff members or investment oficers who reported through the Director of Alternative Investments to the Chief Investment Oficer, who reported to the Comptroller with respect to investment decisions.

5. During the administration of Alan Hevesi, who was Comptroller from January 2003 through December 2006 ("Hevesi"), the CRF invested the majoity of its alternative investments portfolio in pivate equity funds. Beginning in approximately 2005, the CRF also began to invest in hedge funds. The CRF generally invested in pivate equity funds as one of vaious limited partners. In these investments, a separate investment manager generally served as the general partner which managed the day-to-day investment. The alternative investment portfolio also included investments in fund-of-funds, which are investments in a portfolio of pivate equity or hedge funds. The CRF invested as a limited partner in fund-of-funds. In other words, the CRF would place a lump sum with a fund and that fund would essentially manage the investment of these monies by investing in a portfolio of other sub-funds.

6. The CRF was a large and desirable source of investments funds. Gaining access to and investments from the CRF was a competitive process, and frequently the investment manager who served as the general partner of the funds retained third parties known as "placement agents" or "inders" (hereinafter "placement agents") to introduce and market them to CRF. If an investment manager paid a fee to the placement agent in connection with an investment made by the CRF, the CRF required that the investment manager make a witten disclosure of the fee and the identity of the placement agent to the Chief Investment Officer or to the manager of the fund-of-funds.

7. Once the CRF was introduced to and interested in the fund, the fund was referred to one of CRF's outside consultants for due diligence. At the same time, a CRF investment officer was assigned to review and analyze the transaction. If the outside consultant found the transaction suitable, the investment officer then determined whether to recommend the investment to the Director of Alternative Investments.

8. If the investment officer recommended a proposed private equity investment, and the Director of Alternative Investments concurred, then the recommendation was forwarded to the Chief Investment Officer for approval. If the Chief Investment Oficer approved, he recommended the investment to the Comptroller, whose approval was required before the CRF would make a direct investment. There was a similar process for hedge fund investments, which required the recommendation of the senior investment officer to the Chief Investment Officer and the Chief Investment Officer's approval and recommendation to the Comptroller. Given this process, the Chief Investment Oficer could not make an investment unless the proposed investment had been vetted by an outside consultant and recommended by multiple levels of investment staff, including the Director of Alternative Investments, the Chief Investment Officer and the Comptroller.

9. Placement agents and other third parties who are engaged in the business of effecting securities transactions and who receive a commission or compensation in connection with that transaction are required to be licensed and affiliated with broker-dealers regulated by an entity now known as the Financial Industry RegulatoryAuthoity ("FINRA"). To obtain such licenses, the agents are required to pass the "Series 7" or equivalent examination administered by FINRA.

10. As a result of the Investigation, a grand jury returned a 123-count indictment (the Indictment") of Henry "Hank" Morris, the chief political officer to Hevesi, and David Loglisci, the CRF's Director of Alternative Investments and then Chief Investment Oficer. The Indictment charges Morris and Loglisci with enterprise corruption and multiple violations of the Martin Act, money laundering, grand larceny, falsifying business records, offering a false instrument for iling, receiving a reward for official misconduct, bribery, rewarding oicial misconduct and related offenses. The Indictment alleges the following facts in relevant part as set forth in this Part III of the Assurance.

11. Moris, the chief political advisor to Hevesi, and Loglisci, joined forces in a plot to sell access to billions of taxpayer and pension dollars in exchange for millions ofdollars in political and personal gain. Morris steered to himself and certain associates an array of investment deals from which he drew tens of millions of dollars in so-called placement fees. He also used his unlawful power over the pension fund to extract vast amounts of political contributions for the Comptroller's re-election campaign from those doing business and seeking to do business with the CRF.

12. In November 2002, Hevesi was elected to serve as Comptroller, and took ofice on January 1, 2003. Prior to and ater the 2002 election, Morris served as Hevesi's paid chief political consultant and advisor. Upon Hevesi taking ofice in 2003, Morris began to exercise control over certain aspects of the CRF, including the alternative investment portfolio.

13. Moris asserted control over CRF business by recommending, approving, secuing or blocking alternative investment transactions. Morris also inluenced the CRF to invest for the irst time in hedge funds, an asset class that was perceived to be riskier than pivate equity funds, so that Moris and his associates could reap fees from hedge fund transactions involving the CRF.

14. Moris participated in discussions to remove and promote certain executive staff at the CRF. In or about April 2004, for example, Moris and certain other high-ranking OSC oficials determined that the oiginal Chief Investment Oficer of the CRF was not sufficiently accommodating to Moris and his associates. Moris participated in the decision to remove the original Chief Investment Oficer and promote Loglisci to that position.

15. Beginning in 2003, Morris also began to market himself as a placement agent to pivate equity and hedge funds seeking to do business with the CRF. At the same time that Moris was proiting through investment transactions involving the CRF, Morris participated with Loglisci in making decisions about investments. In particular, during the Hevesi administration, Moris occupied three conlicting roles at the CRF although he had no official position there: (1) he advised and helped manage the CRF's alternative investments, acting as a de facto Chief Investment Oficer; (2) he brokered deals between the CRF and politically-connected outside investment funds offering investment management services, earning millions in undisclosed fees as a placement agent; and (3) he had a commercial, personal and political relationship as the Comptroller's chief political strategist and fundraiser.

16. Through his role at the CRF, Moris became a de facto and functional fiduciary to the CRF and its members and beneiciaies, and owed a fiduciary duty to act in the best interests of the CRF and its members and beneficiaies. However, Moris breached this duty and used his influence over the CRF investment process to enich himself and other associates. Morris's multiple roles generated conlicts of interest, which Loglisci

had knowledge of and failed to disclose.

17. Loglisci ceded decision-making authority to Morris regarding particular investments and investment strategies to be pursued and approved by the CRF. During this time, Loglisci was also aware that Moris had an ongoing relationship with the Comptroller. Loglisci was a fiduciary to the CRF and a public oficer with duties pursuant to the Public Oficers Law and therefore had a duty to disclose his own and others' actual and potential conlicts of interests. Loglisci failed to disclose Moris's role to members and beneficiaies of the CRF through the CRF's annual report or otherwise. Loglisci and Moris concealed their corrupt arrangement and Moris's role in investment transactions from the investment staff, ethics oficers, and lawyers at CRF. Additionally, Loglisci failed to disclose his own conlicts of interest involving the financing and distribution of his brother's ilm, "Chooch," by Morris and other persons receiving an investment commitment from the CRF. [Beware pension investments in movies called, "Chooch."]

18. In sum, from 2003 through 2006, through Morris's and Loglisci's actions as described above, the process of selecting investments at the CRF - investments of billions of dollars - was skewed and corrupted to favor political associates, family and friends of Morris and Loglisci, and other oicials in the Office of the State Comptroller. Morris and Loglisci corrupted the alternative investment selection process by making investment decisions based on the goal of rewarding Moris and his associates, rather than based exclusively on the best interests of the CRF and its members and beneiciaies. Moris and Loglisci favored deals for which Morris and his associates acted as placement agents, or had other financial interests, which interests were oten concealed from investment staff and others. The scheme was manifested in several ways:

a. In some instances, Moris and Loglisci blocked proposed CRF investments where the private equity fund or hedge fund would not pay them or their associates.

b. In yet others, Moris inserted his associates as placement agents, who then shared fees with Moris and on others, Morris, Loglisci and their

associates inserted placement agents into proposed transactions as a reward for past political favors.

c. On one transaction, Morris was a principal of an investment in which Morris served as placement agent.

d. On some transactions, Moris was the placement agent through a broker/dealer, Searle & Company ("Searle") or another entity controlled by Moris and Moris shared fees with an associate. On certain other transactions, the structure was reversed, so that an associate of Morris was

the placement agent, who shared fees with Morris. These fee sharing arrangements were oten not disclosed to fund managers or to the CRF

investment staff, other than Loglisci.

19. Moris concealed his conlicting roles as political consultant, CRF gatekeeper and CRF placement agent from the CRF alternative investment staff and others. Morris also concealed inancial relationships he had with Loglisci and another OSC oficial.

At times, Moris concealed his role as CRF investment gatekeeper from funds that hired him as a placement agent. In some instances, Morris obtained placement agreements and fees for himself and others from certain fund managers through false and misleading representations and material omissions, including claims that Searle was the oficial placement agent for the CRF.

20. Loglisci helped to conceal his and Morris's scheme by maintaining exclusive custody of letters to the CRF that disclosed the use of placement agents and fees paid relating to certain CRF investment transactions.

21. As a result of Morris and Loglisci's scheme, Morris and his associates earned fees on more than ive billion dollars in commitments to more than twenty pivate equity funds, hedge funds, and fund-of-funds duing the Hevesi administration. These deals generated tens of millions of dollars in fees to Morris and his associates.

FINDINGS AS TO WETHERLY

22. The Investigation revealed that Wetherly was retained by Freeman Spogli & Co. ("Freeman Spogli") as of February 15, 2002. The "consulting agreement" between Wetherly and Freeman Spogli listed a group of targeted investors to whom Wetherly would market FS Equity Partners V. Their agreement was amended on or about January 8, 2003 to include three additional targeted investors, including the CRF. According to the placement agreement, Freeman Spogli would pay Wetherly a placement fee equivalent to 1% of any capital committed to FS Equity Partners V by an enumerated targeted investor.

23. Julio Ramirez, Jr., ("Ramirez"), who worked as an unlicensed placement agent at Wetherly, took the lead in marketing FS Equity Partners V to the CRF. Wetherly entered into an agreement with Moris, whereby Moris would receive 40% of fees received by Wetherly in connection with any CRF investment in Freeman Spogli. Morris agreed to help Wetherly place Freeman Spogli at the CRF. Moris's agreement with Wetherly was not reduced to writing, and Morris was not a licensed placement agent at the time that he entered into this arrangement.

24. Freeman Spogli was not aware that Morris would be involved in the FS Equity Partners V placement with the CRF, or that Wetherly had entered into an arrangement with Moris.

25. On or about December 29, 2003, the CRF invested $50 million in FS Equity Partners Fund V. In accordance with its agreement with Wetherly, Freeman Spogli paid Wetherly 1% of CRF's $50 million commitment, or $500,000, in or about January 2004. As agreed upon by Moris and Wetherly, and without Freeman Spogli's knowledge, Wetherly paid Moris 40% of its fee indirectly through Ramirez. Upon receipt of the $500,000 fee, Wetherly paid Ramirez $200,000 on or about February 2, 2004. Ramirez in turn wrote a $200,000 check dated February 5, 2004 to PB

Placement LLC, a shell company controlled by Moris. The post-closing disclosure letter did not inform the CRF of the payments to Moris.

B. Ares Corporate Opportunities Fund

26. In or about August of 2002, Ares Management, LLC ("Ares") retained a California-based lobbying irm (the "California Lobbyist") as a placement agent. Although the California Lobbyist was registered as a lobbyist in California, the California Lobbyist was not a broker-dealer, and nobody at the California Lobbyist was properly registered to buy and sell securities until at least 2006. The placement agreement between Ares and the California Lobbyist contemplated a limited number of institutional investors to whom the California Lobbyist would market the Ares Corporate Opportunities Fund ("ACOF"). The oiginal August 2002 agreement between Ares and the California Lobbyist included an enumerated list of targeted investors. A February 2003 amendment to that agreement added the CRF as a potential investor.

27. In or about February of 2003, Wetherly entered into a sub-inder arrangement with the California Lobbyist with respect to the ACOF. Wetherly represented to the California Lobbyist and Ares that it had relationships with pincipals at a number of institutional investors, including the CRF. According to its agreement, the California Lobbyist was to receive 1.5% of capital committed to ACOF by the CRF. The California Lobbyist in turn agreed to pay Wetherly either 50% or 85% of its placement fee, depending on the institutional investor. Although the CRF does not appear either

on the February 2003 sub-inding agreement between the California Lobbyist and Wetherly, or a subsequent amendment to that agreement, the investigation revealed that Ares ultimately agreed to pay Wetherly directly on its share of any CRF investment in

ACOF.

28. As with FS Equity Partners V, Ramirez took the lead in marketing ACOF to the CRF. Wetherly entered into an agreement with Morris, whereby Morris would receive 40% of fees received by Wetherly in connection with any CRF investment in the ACOF. Moris agreed to help Wetherly place the ACOF at the CRF. As with FS Equity Partners V, Moris's agreement with Wetherly was not reduced to witing, and Morris was not a licensed placement agent at the time that he entered into this arrangement.

29. Ares was not aware that Moris would be involved in the CRF placement, or that Wetherly had entered into an arrangement with Moris.

30. On or about December 31, 2003, CRF invested $50 million in the ACOF. In accordance with its agreements with the California Lobbyist and Wetherly, over the next two years, Ares paid the California Lobbyist $112,500 and Ares paid Wetherly $637,500, totaling $750,000 or approximately 1.5% of CRF's $50 million commitment. As agreed upon by Morris and Wetherly, Wetherly paid Morris 40% of fees received by it indirectly through Ramirez. Upon receipt of each fee payment from Ares, Wetherly paid Ramirez, who in turn wrote checks to PB Placement LLC, a shell company controlled by Morris. In total, Wetherly paid Ramirez $225,000 intended for Moris. The post-closing disclosure letter did not inform the CRF of the payments to Moris.

C. Levine Leichtman Capital Partners Fund III

31. In or about February 2004, Levine Leichtman Capital Partners ("LLCP") retained Wetherly as a placement agent for Levine Leichtman Capital Partners Fund III ("LLCP III"). LLCP agreed to pay Wetherly the equivalent of 1% of any capital committed by CRF or its affiliates to LLCP III. An express provision of the retention letter executed by LLCP and Wetherly provided that Wetherly "may separately engage, at its own and with the prior written approval of [LLCP], sub-agents as it may deem necessary or appropiate." However, at no time did Wetherly seek LLCP's consent to

the hiring of any sub-agents.

32. Wetherly began marketing LLCP III to Aldus Equity ("Aldus") starting in or about early 2005. On behalf of the CRF, Aldus managed the Aldus/NY Emerging Fund, a discretionary fund of funds. Pursuant to that marketing effort, Wetherly entered into a witten sub-agent agreement with Searle & Co. ("Searle"), a registered broker/dealer with which Hank Morris was affiliated. The agreement between Wetherly and Searle was dated as of March 1, 2005, though Searle did not execute the agreement until on or about August 6, 2005. As indicated in the agreement, Wetherly was to pay Searle 40% of all placement fees Wetherly received in connection with any CRF investment in LLCP III. LLCP was not aware of the fact, or the details, of Wetherly's arrangement with Searle and Moris.

33. Wetherly assisted in the placement of LLCP III with the Aldus/NY Emerging Fund. Moris, through a wholly-owned entity, received 35% of management fees theCRF paid to Aldus with respect to the Aldus/NY Emerging Fund. In or about March 2005, Aldus invested $20 million of the Aldus/NY Emerging Fund into LLCP III.

34. LLCP paid Wetherly $200,000 in placement fees (an amount equal to 1% of the Aldus/NY Emerging Fund capital commitment to LLCP III). Wetherly then paid Searle $80,000 or 40% of the amount it received from LLCP. Moris received $76,000 from Searle. Wetherly did not disclose to LLCP the fact of these payments to Searle or Morris.

D. Campaign Contributions

37. Ramirez solicited the other Wetherly Pincipals for campaign contibutions for Hevesi, and on or about June 20, 2003, Wetherly contibuted $2,500 to Hevesi's re-election campaign. Subsequently, Wetherly was solicited for campaign contributions by Hevesi's campaign fundraiser. Wetherly contributed an additional $11,500 to Hevesi's re-election campaign on or about December 6, 2004 and April 15, 2005. In total, Wetherly contributed $14,000 to the Hevesi campaign.

AGREEMENT

WHEREAS, Wetherly wishes to resolve the Investigation and is willing to abide by the terms of this Agreement set forth below;

WHEREAS, Wetherly does not admit or deny the Attorney General's findings as set forth in this Assurance;

WHEREAS, the Attorney General is willing to accept the terms of the Assurance pursuant to New York Executive Law § 63(15), and to discontinue, as descibed herein, the Investigation of Wetherly;

WHEREAS, the parties believe that the obligations imposed by this Assurance are prudent and appropriate; IT IS HEREBY UNDERSTOOD AND AGREED, by and between the parties, as follows:

I. CONDUCT

38. The Attorney General and Wetherly hereby enter into the attached Public Pension Fund Reform Code of Conduct, which is hereby incorporated by reference as if fully set forth herein.

39. Wetherly hereby agrees to immediately and permanently cease acting as a Placement Agent in connection with Public Pension Fund investments in the United States. Wetherly Capital Group, LLC further agrees to wind down within the 18 months following entry of this Assurance of Discontinuance. Capitalized terms are as defined in the Attorney General's Public Pension Fund Code of Conduct.

40. The Principals of Wetherly further agree to comply with the Attorney General's Public Pension Fund Code of Conduct as it pertains to them with respect to any activities they participate in apart from Wetherly. The Code precludes the Principals from being engaged by an Investment Firm to provide advice, consulting and/or marketing services in connection with potential investments by a Public Pension Fund,other than where acting as a principal, shareholder, or bona fide employee of the investment irm, where the engagement involves direct or indirect communications by the Principals with any Official, Public Pension Fund Official, Public Pension Fund Advisor, or other Public Pension Fund fiduciary or employee with respect to the investment. [CUOMO JUST TURNED YOU INTO HELLEN KELLER, DAN & VICKY...LMFAO! I'm hiring for interns at my blog studio.]

II. PAYMENT

41. Upon the signing of this Assurance, Wetherly agrees to pay a total of ONE MILLION ($1,000,000) DOLLARS to the Office of the Attorney General. Payment shall be effectuated as follows: (This next part looks like a ransom note.)

a. Within 180 days of the signing of this Assurance, Wetherly shall make a payment of FOUR HUNDRED THIRTY THOUSAND ONE HUNDRED

NINETY THREE DOLLARS AND EIGHTY TWO CENTS ($430,193.82) to the State of New York, which will in turn be returned by the Attorney General to the CRF for the benefit of its members, and shall not be used for any other purpose,

b. Within 360 days of the signing of this Assurance, Wetherly shall make a payment of THREE HUNDRED THOUSAND ($300,000) DOLLARS to...

By its terms, the Public Pension Fund Reform Code of Conduct does not prohibit signatories from advising private equity firms regarding marketing strategies concerning Public Pension funds. the State of New York, which will in turn be returned by the Attorney

General to the CRF for the benefit of its members, and shall not be used for any other purpose,

c. Wetherly is hereby credited with a payment in an amount equal to TWO HUNDRED THOUSAND ($200,000) DOLLARS that it previously paid

LLCP, which LLCP turned over to the Office of the Attorney General upon the signing of its own Assurance of Discontinuance on or about

September 17, 2009, and which has been returned by the Attorney General to the CRF for the benefit of its members.

d. Within 30 days of the signing this assurance, Wetherly shall make a payment of SIXTY NINE THOUSAND EIGHT HUNDRED SIX

DOLLARS AND EIGHTEEN CENTS ($69,806.18), which payment shall be designated as costs incurred by the Attorney General in its

investigation. This payment shall be made by certified or bank check directly to Stroz Friedberg LLC, 32 Avenue of the Americas, Fourth

Floor, New York, New York, 10013, Attn: Ed Stroz.

42. Except as otherwise provided in paragraph 41, each payment shall be in the form of a certified or bank check made out to "State of New York" and mailed or otherwise delivered to: Office of the Attorney General of the State of New York, 120 Broadway 25 Floor, New York, New York 10271, Attn: Linda Lacewell, Special Counsel.

43. Wetherly agrees that it shall not, collectively or individually, seek or accept, directly or indirectly, reimbursement or indemnification, including, but not limited to, payment made pursuant to any insurance policy, with regard to any or all of the amounts payable pursuant to paragraph 42 above.

HI. GENERAL PROVISIONS

44. Wetherly admits the jurisdiction of the Attorney General. Wetherly is committed to complying with relevant laws to include the Martin Act, General Business Law §349, and Executive Law § 63(12).

45. The Attorney General retains the ight under Executive Law § 63(15) to compel compliance with this Assurance. Evidence of a violation of this Assurance proven in a court of competent juisdiction shall constitute pima facie proof of a violation of the Martin Act, General Business Law § 349, and/or Executive Law § 63(12) in any civil action or proceeding hereater commenced by the Attorney General against Wetherly.

46. Should the Attorney General prove in a court of competent jurisdiction that a mateial breach of this Assurance by Wetherly has occurred, Wetherly shall pay to the Attorney General the cost, if any, of such determination and of enforcing this Assurance, including without limitation legal fees, expenses and court costs.

47. If Wetherly defaults on any obligation under this Assurance, the Attorney General may terminate this Assurance, at his sole discretion, upon 10 days written notice to Wetherly. Wetherly agrees that any statute of limitations or other time-related defenses applicable to the subject of the Assurance and any claims arising rom or relating thereto are tolled from and ater the date of this Assurance. In the event of such termination, Wetherly expressly agrees and acknowledges that this Assurance shall in no way bar or otherwise preclude the Attorney General from commencing, conducting or prosecuting any investigation, action or proceeding, however denominated, related to the Assurance, against Wetherly, or from using in any way any statements, documents or other mateials produced or provided by Wetherly pior to or ater the date of this Assurance, including, without limitation, such statements, documents or other mateials, if any, provided for purposes of settlement negotiations, except as otherwise provided in a witten agreement with the Attorney General.

48. Except in an action by the Attorney General to enforce the obligations of Wetherly in this Assurance or in the event of termination of this Assurance by the Attorney General, neither this Assurance nor any acts performed or documents executed in furtherance of this Assurance: (a) may be deemed or used as an admission of, or evidence of, the validity of any alleged wrongdoing, liability or lack of wrongdoing or liability; or

(b) may be deemed or used as an admission of or evidence of any such alleged fault or omission of Wetherly in any civil, ciminal or administrative proceeding in any court, administrative or other tibunal. This Assurance shall not confer any ights upon persons or entities who are not a party to this Assurance.

49. Wetherly has fully and promptly cooperated in the Investigation, shall continue to do so, and shall use its best efforts to ensure that all the current and former officers, directors, trustees, agents, members, partners and employees of Wetherly (and any of Wetherly's parent companies, subsidiaies or affiliates) cooperate fully and promptly with the Attorney General in any pending or subsequently initiated investigation, litigation or other proceeding relating to the subject matter of the Assurance. Such cooperation shall include, without limitation, and on a best efforts basis:

a. Production, voluntarily and without service of a subpoena, upon the request of the Attorney General, of all documents or other tangible evidence requested by the Attorney General, and any compilations or summaies of information or data that the Attorney General requests that

Wetherly (or Wetherly's parent companies, subsidiaries or afiliates) prepare, except to the extent such production would require the disclosure

information protected by the attorney-client and/or work product privileges;

b. Without the necessity of a subpoena, having the current (and making all reasonable efforts to cause the former) officers, directors, trustees, agents, members, partners and employees of Wetherly (and of Wetherly's parent companies, subsidiaries or afiliates) attend any Proceedings (as

hereinafter deined) in New York State or elsewhere at which the presence of any such persons is requested by the Attorney General and having such current (and making all reasonable efforts to cause the former) oficers, directors, trustees, agents, members, partners and employees answer any and all inquiries that may be put by the Attorney General to any of the them at any proceedings or otherwise; "Proceedings" include, but are not limited to, any meetings, interviews, depositions, heaings, tials, grand jury proceedings or other proceedings;

c. Fully, fairly and truthfully disclosing all information and producing all records and other evidence in its possession, custody or control (or the

possession, custody or control of Wetherly's parent companies, subsidiaies or afiliates) relevant to all inquiries made by the Attorney General concerning the subject matter of the Assurance, except to the extent such inquiries call for the disclosure of information protected by the

attorney-client and/or work product privileges; and

d. Making outside counsel reasonably available to provide comprehensive presentations concerning any internal investigation relating to all matters in the Assurance and to answer questions, except to the extent such presentations call for the disclosure of information protected by the attorney-client and/or work product privileges.

50. In the event Wetherly fails to comply with paragraph 49 of the Assurance, the Attorney General shall be entitled to speciic performance, in addition to other available remedies.

51. The Attorney General has agreed to the terms of this Assurance based on, among other things, the representations made to the Attorney General and his staff by Wetherly, its counsel, and the Attorney General's Investigation. To the extent that representations made by Wetherly or its counsel are later found to be materially incomplete or inaccurate, this Assurance is voidable by the Attorney General in his

sole discretion.

52. Wetherly shall, upon request by the Attorney General, provide all documentation and information reasonably necessary for the Attorney General to veify compliance with this Assurance.

53. All notices, reports, requests, and other communications to any party pursuant to this Assurance shall be in writing and shall be directed as follows:

If to Wetherly:

Andrew E. Tomback

Milbank, Tweed, Hadley & McCloy LLP

One Chase Manhattan Plaza

New York, NY 10005

If to the Attorney General:

Office of the Attorney General of the State of New York

120 Broadway, 25th Floor

New York, New York 10271

Attn: Linda Lacewell

54. This Assurance and any dispute related thereto shall be governed by the laws of the State of New York without regard to any conflicts of laws principles.

55. Wetherly consents to the juisdiction of the Attorney General in any proceeding or action to enforce this Assurance.

56. Wetherly agrees not to take any action or to make or permit to be made any public statement denying, directly or indirectly, any inding in this Assurance or creating the impression that this Assurance is without factual basis. Nothing in this paragraph affects Wetherly's: (a) testimonial obligations; or (b) ight to take legal or factual positions in defense of litigation or other legal proceedings to which the Attorney

General is not a party.

57. This Assurance may not be amended except by an instrument in witing signed on behalf of the parties to this Assurance.

58. This Assurance constitutes the entire agreement between the Attorney General and Wetherly and supersedes any prior communication, understanding or agreement, whether witten or oral, concerning the subject matter of this Assurance. No representation, inducement, promise, understanding, condition or warranty not set forth in this Assurance has been relied upon by any party to this Assurance.

59. In the event that one or more provisions contained in this Assurance shall for any reason be held to be invalid, illegal, or unenforceable in any respect, such invalidity,illegality, or unenforceability shall not affect any other provision of this Assurance.

60. This Assurance may be executed in one or more counterparts, and shall become effective when such counterparts have been signed by each of the parties hereto.

61. Upon execution by the parties to this Assurance, the Attorney General agrees to suspend, pursuant to Executive Law § 63(15), this Investigation as and against Wetherly, its employees, and its beneicial owners solely with respect to its marketing of investments to public pension funds in New York State.

62. Any payments and all correspondence related to this Assurance must reference AOD# 09-172 WHEREFORE, the following signatures are aixed hereto on the dates set forth below.

ANDREW M. C OM

Attorney General of the State of New York

WETHERLY CAPITAL GROUP, LLC

DAV WETHERLY FINANCIAL, L.P.

Daniel Wienstein

Vicky Schiff

Dated: February 2,2010

X___________________________________

X___________________________________

No comments:

Post a Comment