The February S&P/Case-Shiller (SPCS) data published today showed a slight uptick in home value appreciation for the 10- and 20-City indices, compared to the prior month. However, appreciation in the national index fell slightly in February, to an annual pace of 4.2 percent, from 4.4 percent in January 2015. Annual appreciation in the national series hit a post-bubble peak of 10.9 percent in October 2013 and has declined in every month since December 2013.

The 10- and 20-City Composite Indices both experienced modest bumps in annual growth rates in February; the 10-City index rose 4.8 percent and the 20-City Index rose to 5 percent, up from rates of 4.3 percent and 4.5 percent, respectively, in January. The non-seasonally adjusted (NSA) 10- and 20-City indices were each up 0.5 percent in February from January, and we expect both to show further gains in March.

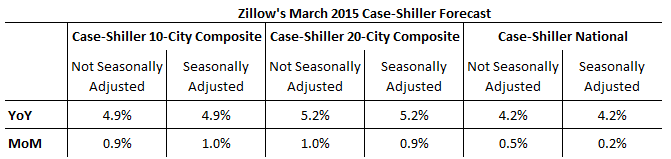

All forecasts are shown in the table below. These forecasts are based on the February SPCS data release and the March 2015 Zillow Home Value Index (ZHVI), published April 22. Officially, the SPCS Composite Home Price Indices for March will not be released until Tuesday, May 26.

Annual appreciation in the Zillow Home Value Index (ZHVI) peaked in April 2014 and has declined since then. In March, the U.S. ZHVI rose 3.9 percent year-over-year, the first month in two years that home values grew at less than 4 percent annually. The annual appreciation rate in home values has fallen for the past 11 months. The March Zillow Home Value Forecast calls for a 2.6 percent rise in home values through March 2016. Further details on our forecast of home values can be found here.

More on the differences between SPCS and ZHVI can be found here. Our commentary on recent revisions to the national S&P/Case-Shiller Index can be found here.