The National Association of Realtors released the Pending Home Sales Index today.

NAR's

Pending Home Sales Index measures the number of home purchase contracts

that were signed in the monthly reporting period. Once "pending" sales

contracts are closed, they are considered an existing home sale.

Because the Pending Home Sales index tells us how many contracts were

signed, it is consider a forward indicator of existing home sales. A

signed contract is not counted as an existing home sale until the

transaction actually closes.

Excerpts from the Release...

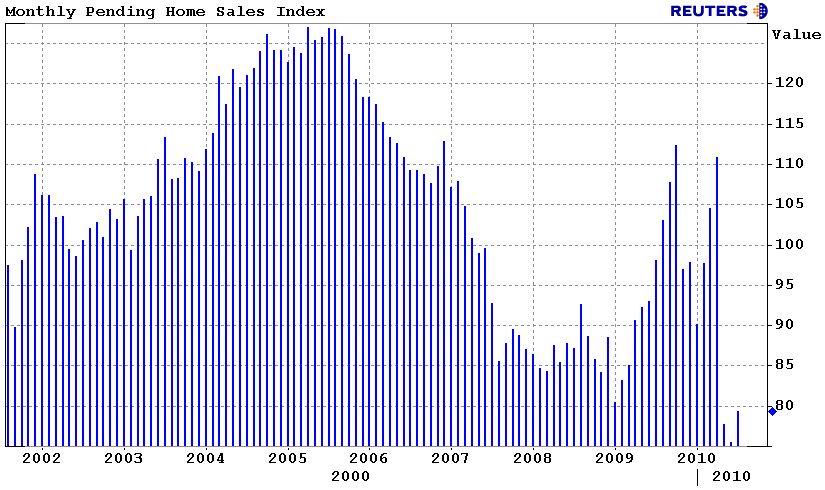

Following a sharp drop in the months immediately after expiration of the home buyer tax credit, pending home sales have modestly risen.

The Pending Home Sales Index, a forward-looking indicator, rose 5.2 percent to 79.4 based on contracts signed in July from a downwardly revised 75.5 in June, but remains 19.1 percent below July 2009 when it was 98.1.

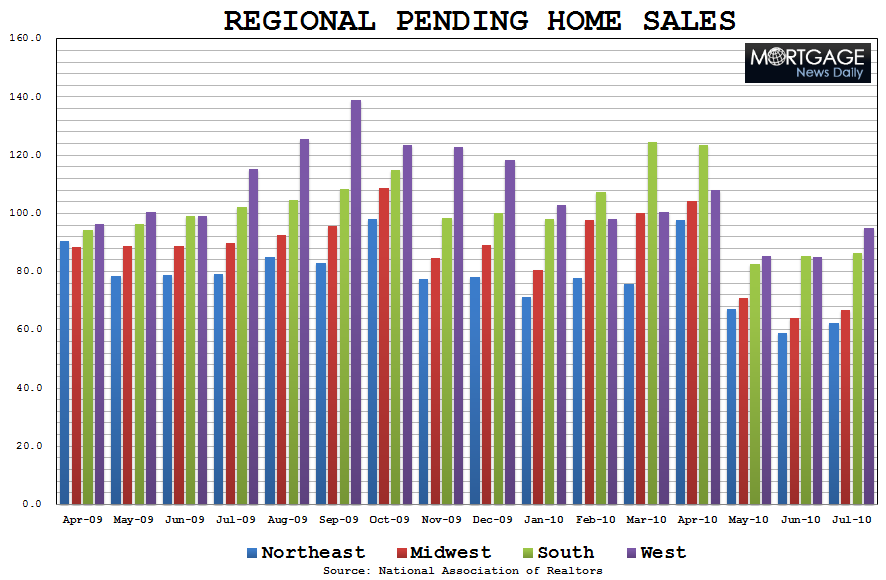

The PHSI in the Northeast rose 6.3 percent to 62.5 in July but is 21.1 percent below a year ago. In the Midwest the index increased 4.1 percent to 66.7 but remains 25.7 percent below July 2009. Pending home sales in the South rose 1.2 percent to an index of 86.3, but are 15.6 percent lower than a year ago. In the West the index jumped 11.6 percent to 95.0 but is 17.6 percent below July 2009.

Lawrence Yun, NAR chief economist, cautioned that there would be a long recovery process. “Home sales will remain soft in the months ahead, but improved affordability conditions should help with a recovery,” he said. “But the recovery looks to be a long process. Home buyers over the past year got a great deal, and buyers for the balance of this year have an edge over sellers. For those who bought at or near the peak several years ago, particularly in markets experiencing big bubbles, it may take over a decade to fully recover lost equity.”

Yun added, “Affordability could reach a generational high in the second half of this year because of rock-bottom mortgage interest rates, helped partly by the Fed’s very accommodative monetary policy. The loan underwriting standards are tighter, but home buyers can improve their chances of getting a loan by staying well within their budget.”

My only comment: There has been talk circulating that the Administration is considering the re-authorization of the expired homebuyer tax credit. While I believe another tax credit would be taking a step in the wrong direction, I do feel the housing market needs to provide more incentive to buy than record affordability. What the housing market does not need is government officials mentioning that incentives will be implemented "if needed". Just talking about another homebuyer tax credit could slow sales in the "here and now" as consumers put off purchase plans in hopes they too will be able to benefit from new stimulus measures. There is no time for dilly-dallying here, the negative feedback loop is already in process. The Administration must either squash the idea of more stimulus, with blunt force, or act quickly to implement new measures so buyers can make informed decisions. Either way....communication is key.

The right incentive for the housing market: EASE CREDIT GUIDELINES! USE SOME COMMON SENSE IN UNDERWRITING!!